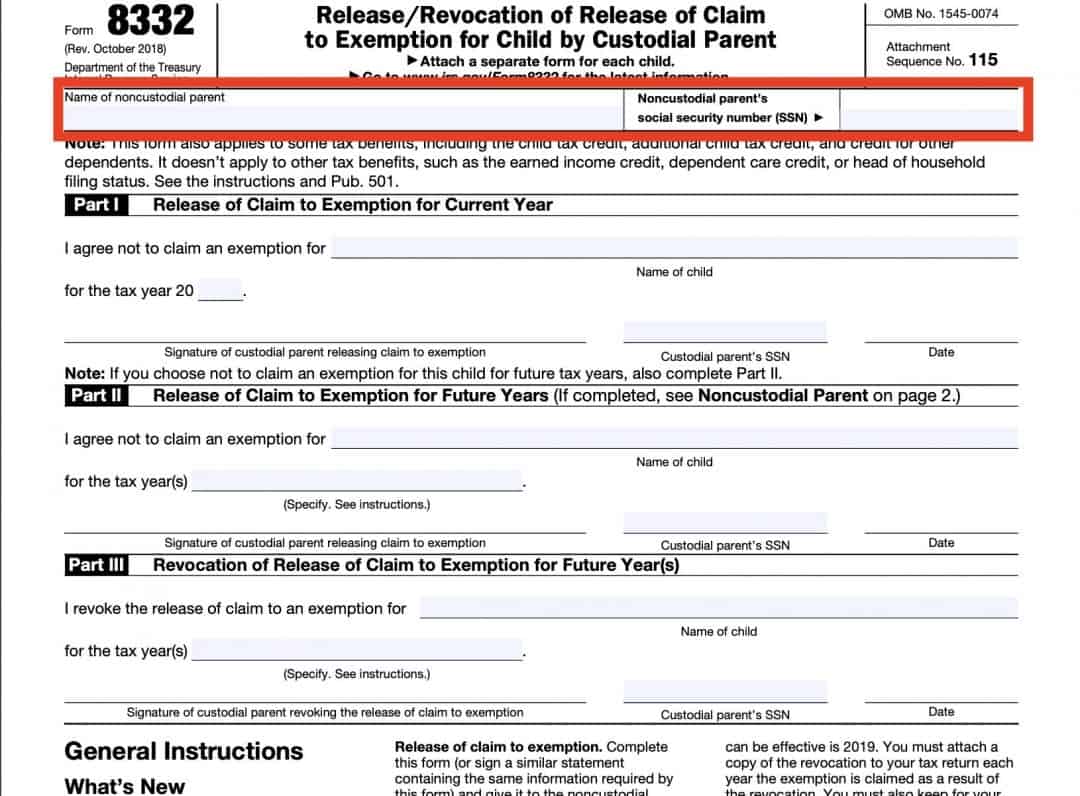

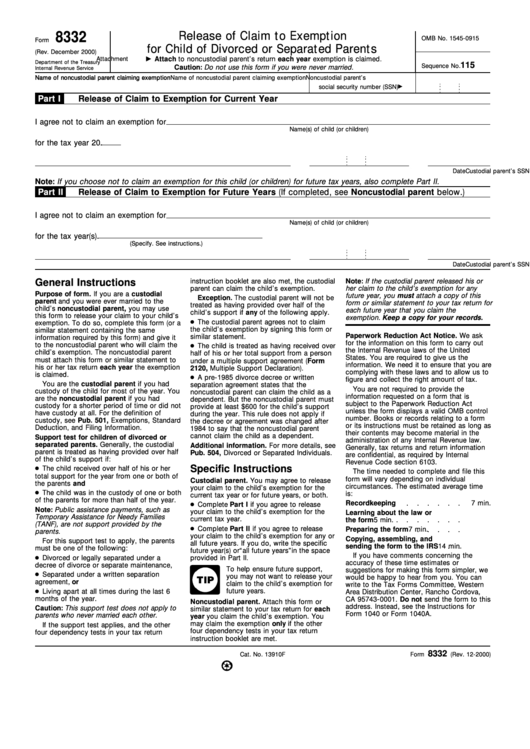

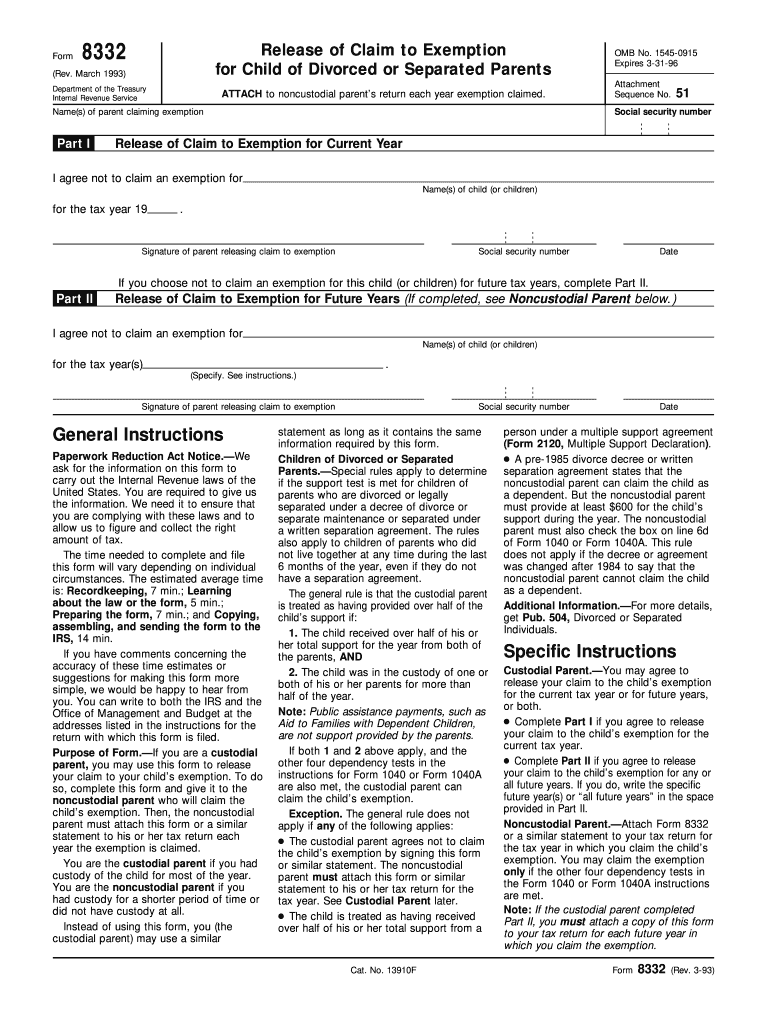

Tax Form 8332 Printable - Print, sign, and distribute to noncustodial parent. Get personalized help join the community sign in to support or sign in to turbotax and start working on your taxes discuss discover community basics connect with others top contributors news & announcements support turbo™ turbotax™ go to turbotax. Share your form with others send form 8332 fillable via email, link, or fax. Name of noncustodial parent claiming exemption release of claim to exemption for current year i agree not to claim an exemption for for the tax year 20. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. Additionally, custodial parents can use tax form 8332 to. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Web employer's quarterly federal tax return. The child is treated as having received over half of his or her total support from a person under a multiple support agreement (form 2120, multiple support declaration).

Printable Irs Forms 2021 8332 Calendar Printable Free

Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022.

IRS Form 8332 A Guide for Custodial Parents

If you don’t have an account yet, register. Web form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Permission can also be granted for future tax years so you do not need to repeatedly file this form. Make entries in these fields: Web get tax form 8332 printable signed right from your.

Printable Irs Forms 2021 8332 Calendar Printable Free

Web form 8332 is used by custodial parents to release their claim to their child's exemption. You are required to give us the information. Web if you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your intermediate service provider and/or transmitter that the.

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

The child is treated as having received over half of his or her total support from a person under a multiple support agreement (form 2120, multiple support declaration). Web prepare the form 8332 on the custodial parent's return. This file should not be sent directly to the irs but to the other parent. If you are the custodial parent, you.

Fillable Form 8332 Release Of Claim To Exemption For Child Of

Web what is the 8332 form? Web the child’s exemption by signing this form or similar statement. Web fillable printable form 8332 what is a form 8332 ? Type signnow.com in your phone’s browser and log in to your account. This file should not be sent directly to the irs but to the other parent.

IRS 8332 1993 Fill out Tax Template Online US Legal Forms

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web form 8332 is a tax form issued by the internal revenue service (irs) that is used to release a claim to exemption for a child. This file should not be sent directly to the irs but.

Child Tax Release Form f8332 Tax Exemption Social Security Number

About form 8832, entity classification election | internal revenue service If you are the custodial parent, you can use form 8332 to do the following. Search for the document you need to electronically sign on your device and upload it. If you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually.

Form 8332 Edit, Fill, Sign Online Handypdf

If you don’t have an account yet, register. If you are the custodial parent, you can use form 8332 to do the following. Web form 8332 is a tax form issued by the internal revenue service (irs) that is used to release a claim to exemption for a child. You are required to give us the information. Web form 8332.

Is IRS tax form 8332 available online for printing? mccnsulting.web

An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: We need it to ensure that you are complying with these laws and to allow us to figure and collect the right. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax.

Printable Irs Forms 2021 8332 Calendar Printable Free

Permission can also be granted for future tax years so you do not need to repeatedly file this form. Web form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Purpose of the document how to fill out a document Release/revocation of release of claim to exemption for child by custodial parent written.

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: You are required to give us the information. Open turbotax sign in why sign in to support? Special rule for children of divorced or separated parents a child is treated as a qualifying child or a If you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that in the taxact® program as follows: Delete the data entered in screen 70, release of claim to exemption (8332) to prevent the form 8453 from generating. Purpose of the document how to fill out a document About form 8832, entity classification election | internal revenue service Web form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. We ask for the information on this form to carry out the internal revenue laws of the united states. Open the doc and select the page that needs to be signed. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Prepare the form 8332 on the noncustodial parent's return. If you are the custodial parent, you can use form 8332 to do the following. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. December 2000) attachment sequence no.115 department of the treasury internal revenue service attach to noncustodial parent’s return each year exemption is claimed. Web the child’s exemption by signing this form or similar statement.

The Form Can Be Used For Current Or Future Tax Years.

You can print other federal tax forms here. Prepare the form 8332 on the noncustodial parent's return. Web where is form 8332? Web employer's quarterly federal tax return.

Open Turbotax Sign In Why Sign In To Support?

You are required to give us the information. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service Instructions for form 941 pdf This can be done by writing “all future years” in part ii.

Web Form 8332 Is Used By Custodial Parents To Release Their Claim To Their Child's Exemption.

Web what is the 8332 form? We ask for the information on this form to carry out the internal revenue laws of the united states. December 2000) attachment sequence no.115 department of the treasury internal revenue service attach to noncustodial parent’s return each year exemption is claimed. Web form 8332 is a tax form issued by the internal revenue service (irs) that is used to release a claim to exemption for a child.

Web If You Are Filing Your Tax Return Using An Online Provider, Mail Form 8453 To The Irs Within 3 Business Days After You Have Received Acknowledgement From Your Intermediate Service Provider And/Or Transmitter That The Irs Has Accepted Your Electronically Filed Tax Return.

The child is treated as having received over half of his or her total support from a person under a multiple support agreement (form 2120, multiple support declaration). Print, sign, and distribute to noncustodial parent. Edit your form 8332 online type text, add images, blackout confidential details, add comments, highlights and more. Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 08:59 am overview having custody of your child usually means you can claim that child as a dependent on your taxes.