Printable Wisconsin 1099 Form - My.unemployment.wisconsin.gov log on using your username and password. December 2014) department of the treasury identification number and certification internal revenue service give form to the. A person is not an. However, some forms require adobe reader version 9 or higher to print properly. Check on your refund other tax links internal revenue service other. For more information, see publication 117 , guide to. Web wisconsin department of revenue: Every pattern on our site is available in a convenient bundle starting at only $19.99. Ad discover a wide selection of 1099 tax forms at staples®. Web wisconsin department of revenue:

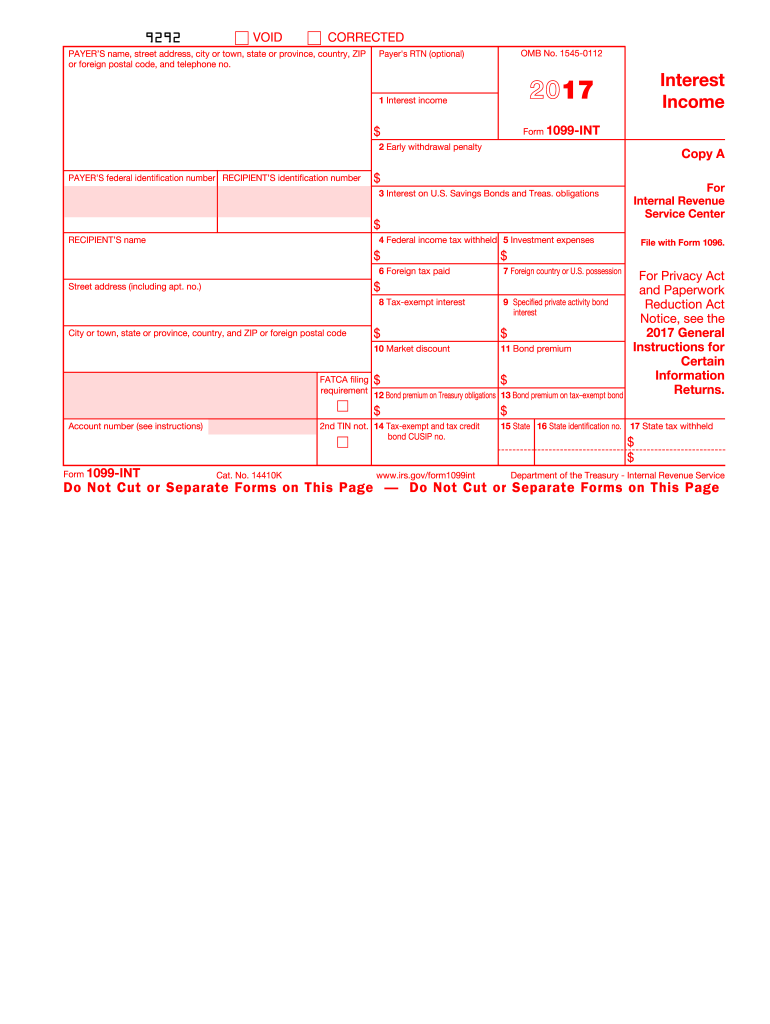

2017 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. However, some forms require adobe reader version 9 or higher to print properly. It provides your annual refund or overpayment credit information. To obtain free adobe reader software,. My.unemployment.wisconsin.gov log on using your username and password.

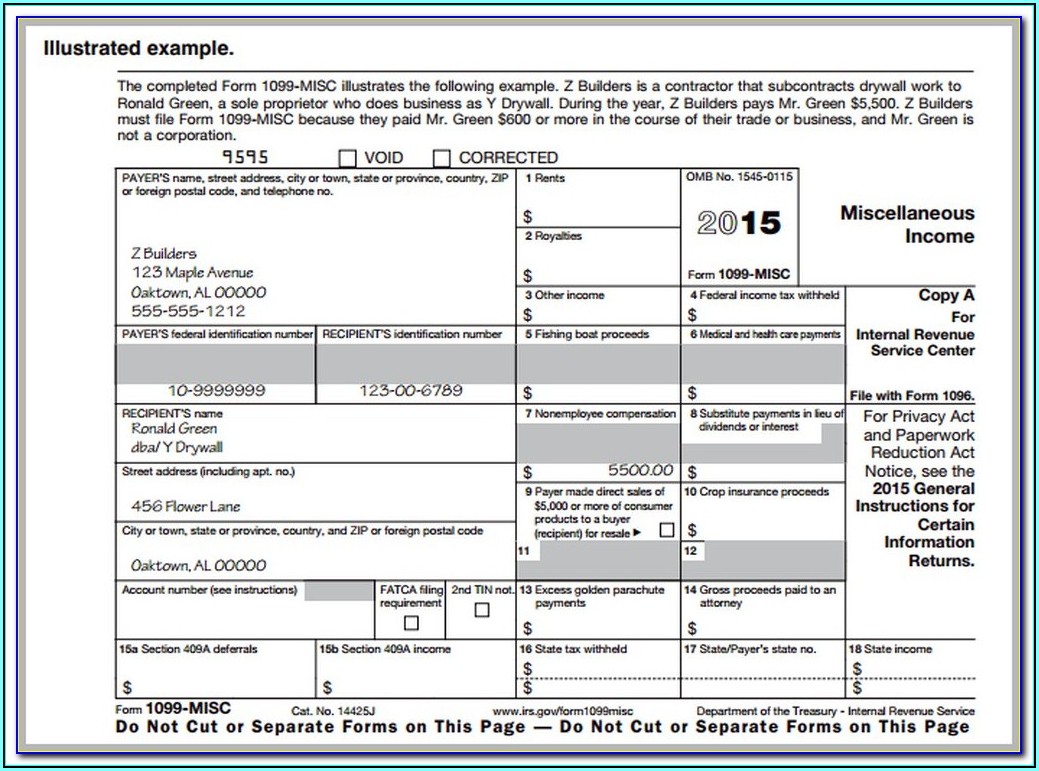

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Requesting previously filed tax returns. 2020 income tax forms for corporations, fiduciaries and estates, individuals, and partnerships October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Claimants' statements are available online for the past six years,. Web wisconsin department of revenue:

1099 Form Fillable Pdf Form Resume Examples Wk9yWNXV3D

Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Sign up now to go paperless. To obtain free adobe reader software,. My.unemployment.wisconsin.gov log on using your username and password.

Wisconsin Form 1099 Filing Universal Network Free Nude Porn Photos

It provides your annual refund or overpayment credit information. For more information, see publication 117 , guide to. Requesting previously filed tax returns. Go to www.irs.gov/freefile to see. However, some forms require adobe reader version 9 or higher to print properly.

Free Printable 1099 Misc Forms Free Printable

2020 income tax forms for corporations, fiduciaries and estates, individuals, and partnerships Check on your refund other tax links internal revenue service other. Sign up now to go paperless. Go to www.irs.gov/freefile to see. Web wisconsin department of revenue:

Form1099NEC

Requesting previously filed tax returns. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Web wisconsin department of revenue: Unemployment benefits paid to you federal and state income taxes withheld from your benefits repayments of overpaid.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

To obtain free adobe reader software,. Web wisconsin department of revenue: However, some forms require adobe reader version 9 or higher to print properly. December 2014) department of the treasury identification number and certification internal revenue service give form to the. For more information, see publication 117 , guide to.

What is a 1099 & 5498? uDirect IRA Services, LLC

Staples provides custom solutions to help organizations achieve their goals. Web income tax return (long form) form 1 is the general income tax return (long form) for wisconsin residents. Unemployment benefits paid to you federal and state income taxes withheld from your benefits repayments of overpaid. Claimants' statements are available online for the past six years,. However, some forms require.

Forms 1099 The Basics You Should Know Kelly CPA

December 2014) department of the treasury identification number and certification internal revenue service give form to the. Web wisconsin department of revenue: Web the 1099 forms will be printed with a payer name of “state of wisconsin consolidated agency reporting” and will include the state ontroller’s office address and telephone. Claimants' statements are available online for the past six years,..

Wisconsin Retirement System Form 1099 R Universal Network

It can be efiled or sent by mail. December 2014) department of the treasury identification number and certification internal revenue service give form to the. To obtain free adobe reader software,. Claimants' statements are available online for the past six years,. Ad discover a wide selection of 1099 tax forms at staples®.

Requesting previously filed tax returns. To obtain free adobe reader software,. Sign up now to go paperless. Ad discover a wide selection of 1099 tax forms at staples®. The internal revenue service requires. Claimants' statements are available online for the past six years,. Unemployment benefits paid to you federal and state income taxes withheld from your benefits repayments of overpaid. A person is not an. Check on your refund other tax links internal revenue service other. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Web wisconsin department of revenue: Web the 1099 forms will be printed with a payer name of “state of wisconsin consolidated agency reporting” and will include the state ontroller’s office address and telephone. It provides your annual refund or overpayment credit information. 2020 income tax forms for corporations, fiduciaries and estates, individuals, and partnerships Staples provides custom solutions to help organizations achieve their goals. For more information, see publication 117 , guide to. Web income tax return (long form) form 1 is the general income tax return (long form) for wisconsin residents. Web wisconsin department of revenue: It can be efiled or sent by mail. My.unemployment.wisconsin.gov log on using your username and password.

Claimants' Statements Are Available Online For The Past Six Years,.

Web wisconsin department of revenue: Check on your refund other tax links internal revenue service other. Sign up now to go paperless. My.unemployment.wisconsin.gov log on using your username and password.

Every Pattern On Our Site Is Available In A Convenient Bundle Starting At Only $19.99.

Please read to see if you qualify. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to. Web income tax return (long form) form 1 is the general income tax return (long form) for wisconsin residents. A person is not an.

2020 Income Tax Forms For Corporations, Fiduciaries And Estates, Individuals, And Partnerships

To obtain free adobe reader software,. It can be efiled or sent by mail. The internal revenue service requires. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,.

December 2014) Department Of The Treasury Identification Number And Certification Internal Revenue Service Give Form To The.

Requesting previously filed tax returns. Web the 1099 forms will be printed with a payer name of “state of wisconsin consolidated agency reporting” and will include the state ontroller’s office address and telephone. Staples provides custom solutions to help organizations achieve their goals. It provides your annual refund or overpayment credit information.