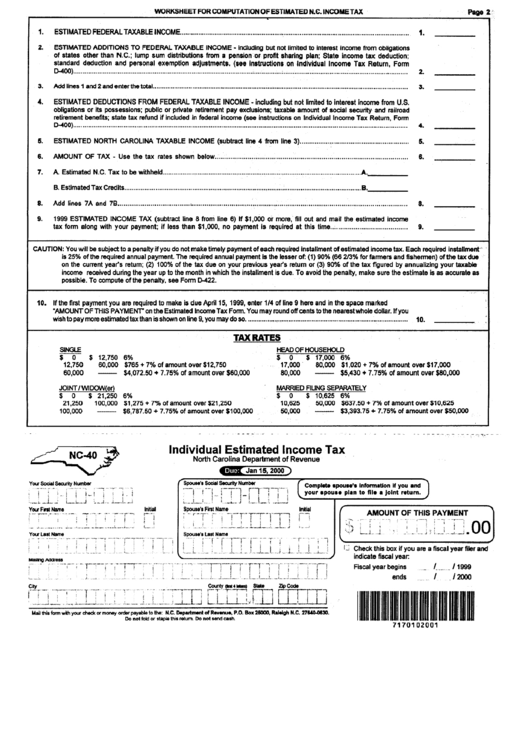

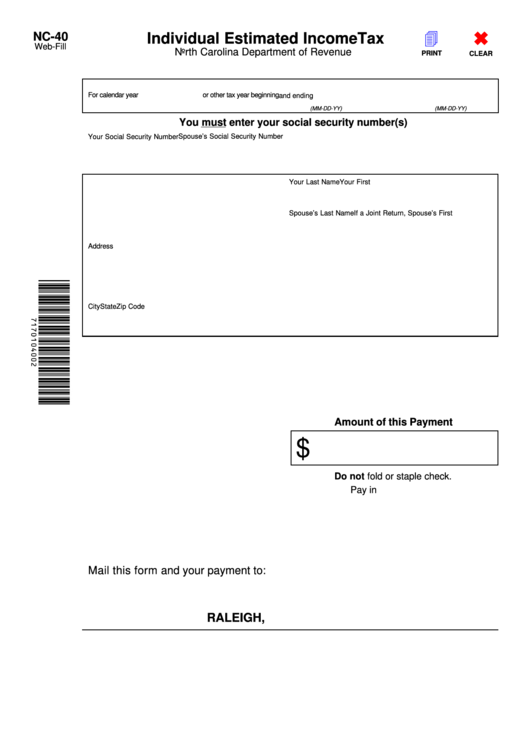

Printable Nc 40 Tax Form - However, you may pay your estimated tax online. Start filing your tax return now. Income tax you expect to owe for the year. Do not staple, tape, or otherwise attach your payment to the form. Use efile to schedule payments for the entire year. Complete this web form for assistance. We will update this page with a new version of the form for 2024 as soon as it is made available by the north carolina government. Extension for filing individual income tax return; Web experience all the benefits of submitting and completing documents online. Show entries showing 1 to 24 of 24 entries previous 1 next

NC DoR NC4 EZ 20192022 Fill out Tax Template Online US Legal Forms

Estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Start filing your tax return now. What is individual estimated income tax? Extension for filing individual income tax return; Web 2015 nc tax forms printable.

Nc 4 rev 1 00 fillable form Fill out & sign online DocHub

The department’s online filing and payment system allows you to electronically file form. Form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. Finish filling out the form with the done button. Click here for helpif the form does not. Web pay individual estimated income tax.

Fillable Form Nc40 Individual Estimated Tax printable pdf

What is individual estimated income tax? Electronic filing options and requirements; Finish filling out the form with the done button. Use efile to schedule payments for the entire year. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Nc 4 Allowance Worksheet Worksheet List

You can print other north carolina tax forms here. Type, draw, or upload an image of your handwritten signature and place it where you need it. Try our free income tax calculator. (8) to insure proper credit, please do not fold the form or the payment. Show entries showing 1 to 24 of 24 entries previous 1 next

Fillable Form Nc40 Individual Estimated printable pdf download

Form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. Finish filling out the form with the done button. With our fillable form 1040 individual income tax return form, you can easily record your tax information from any device and save your entry as a pdf. Web experience all the benefits.

NC DoR D400TC 2014 Fill out Tax Template Online US Legal Forms

Get everything done in minutes. You can print other north carolina tax forms here. Click here for helpif the form does not. Try our free income tax calculator. What is individual estimated income tax?

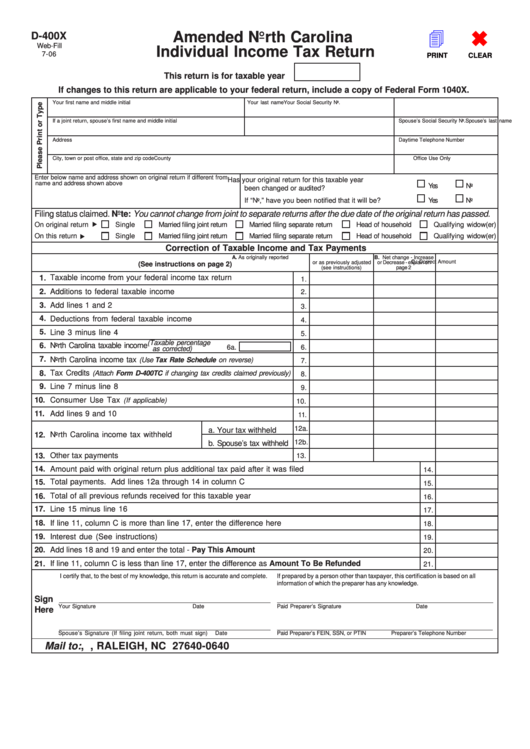

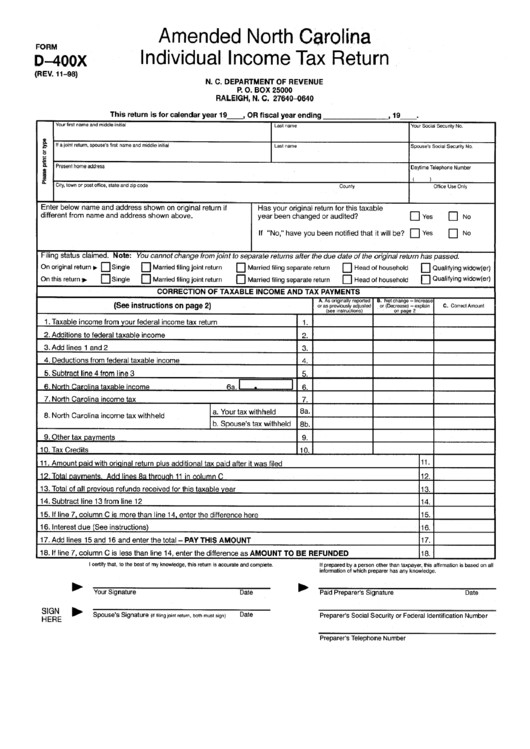

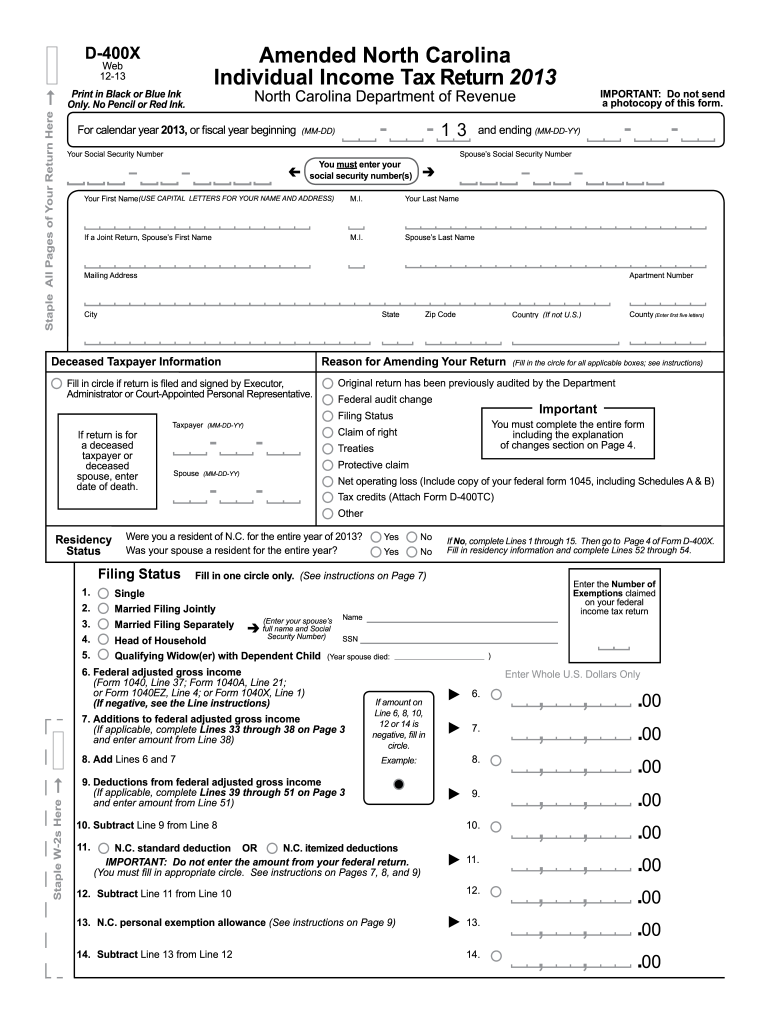

D400x Amended North Carolina Individual Tax Return printable

Get everything done in minutes. Type, draw, or upload an image of your handwritten signature and place it where you need it. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web amended.

Fillable Form D400x Amended North Carolina Individual Tax

The department’s online filing and payment system allows you to electronically file form. Electronic filing options and requirements; Sales and use electronic data interchange (edi) step by step instructions for efile; Nc state tax form 2020. With our fillable form 1040 individual income tax return form, you can easily record your tax information from any device and save your entry.

Amended North Carolina Individual Tax Return 2012 dor state nc

Type, draw, or upload an image of your handwritten signature and place it where you need it. Finish filling out the form with the done button. However, you may pay your estimated tax online. What is individual estimated income tax? If you previously made an electronic payment but did not receive a confirmation page do not submit another payment.

20132023 Form NC DoR NC5X Fill Online, Printable, Fillable, Blank

Show entries showing 1 to 24 of 24 entries previous 1 next This readymade template is a smart pdf form, meaning it will automatically. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. Estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis..

Sales and use electronic data interchange (edi) step by step instructions for efile; Web 2015 nc tax forms printable. However, you may pay your estimated tax online. Who must make estimated income tax payments The current tax year is 2022, with tax returns due in april 2023. With our fillable form 1040 individual income tax return form, you can easily record your tax information from any device and save your entry as a pdf. With our service submitting printable north carolina realtor form 401 t will take a few minutes. Estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Web experience all the benefits of submitting and completing documents online. You can print other north carolina tax forms here. Want to schedule all four payments? Schedule payments up to 365 days in advance; Form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. Get everything done in minutes. Show entries showing 1 to 24 of 24 entries previous 1 next What is individual estimated income tax? Use efile to schedule payments for the entire year. Extension for filing individual income tax return; If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. The department’s online filing and payment system allows you to electronically file form.

The Department’s Online Filing And Payment System Allows You To Electronically File Form.

Finish filling out the form with the done button. Show entries showing 1 to 24 of 24 entries previous 1 next Sales and use electronic data interchange (edi) step by step instructions for efile; Start filing your tax return now.

Get Everything Done In Minutes.

Who must make estimated income tax payments Web pay individual estimated income tax. Try our free income tax calculator. Type, draw, or upload an image of your handwritten signature and place it where you need it.

This Readymade Template Is A Smart Pdf Form, Meaning It Will Automatically.

Withholding from periodic payments of a pension. Do not staple, tape, or otherwise attach your payment to the form. To pay individual estimated income tax: Complete this web form for assistance.

What Is Individual Estimated Income Tax?

(8) to insure proper credit, please do not fold the form or the payment. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. However, you may pay your estimated tax online. Schedule payments up to 365 days in advance;