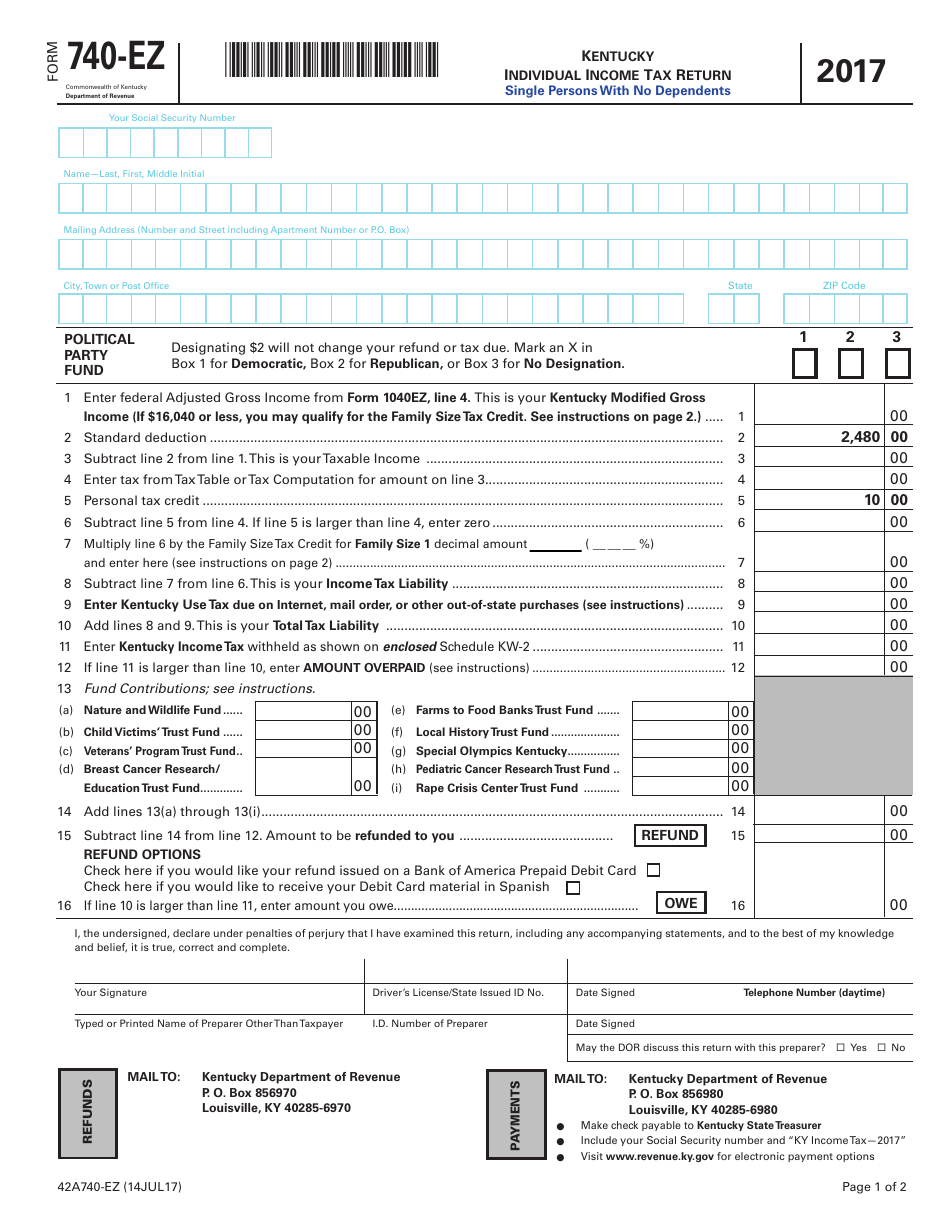

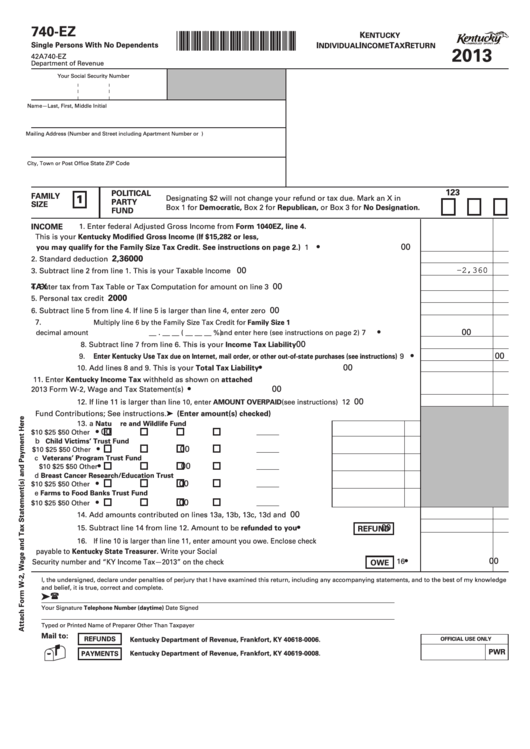

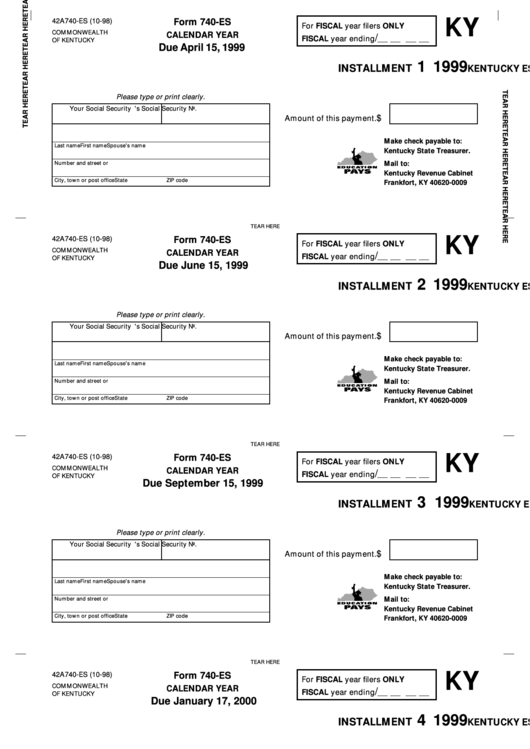

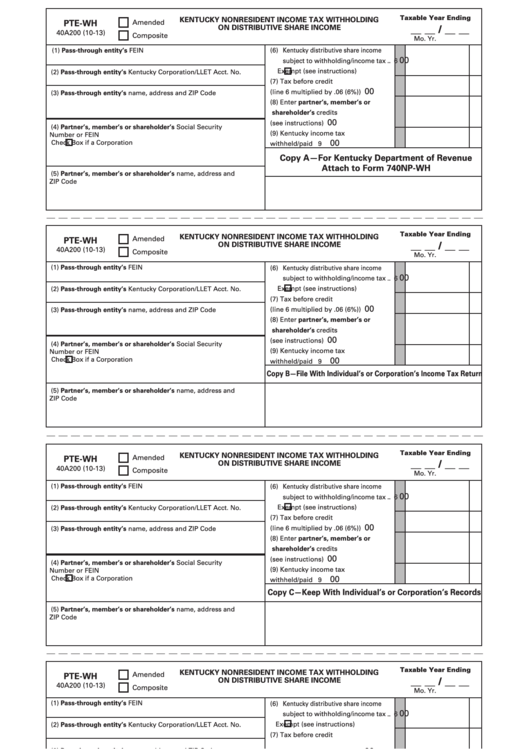

Printable Kentucky State Tax Forms - Web printable income tax forms. Please click here to see if you are required to report kentucky use tax on your individual income tax return. Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Income gap tax credit—this credit has expired. Web use tax on individual income tax return. The current tax year is 2022, with tax returns due in april 2023. • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, The current tax year is 2022, and most states will release updated tax forms between january and april of 2023.

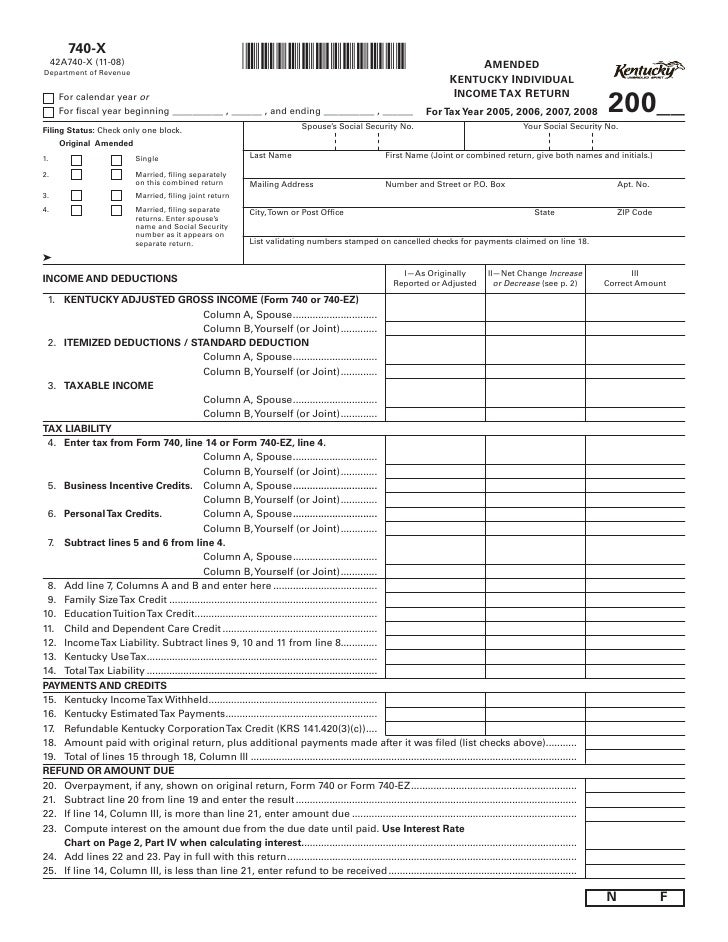

740X Amended Kentucky Individual Tax Return for Tax Year 20…

Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for.

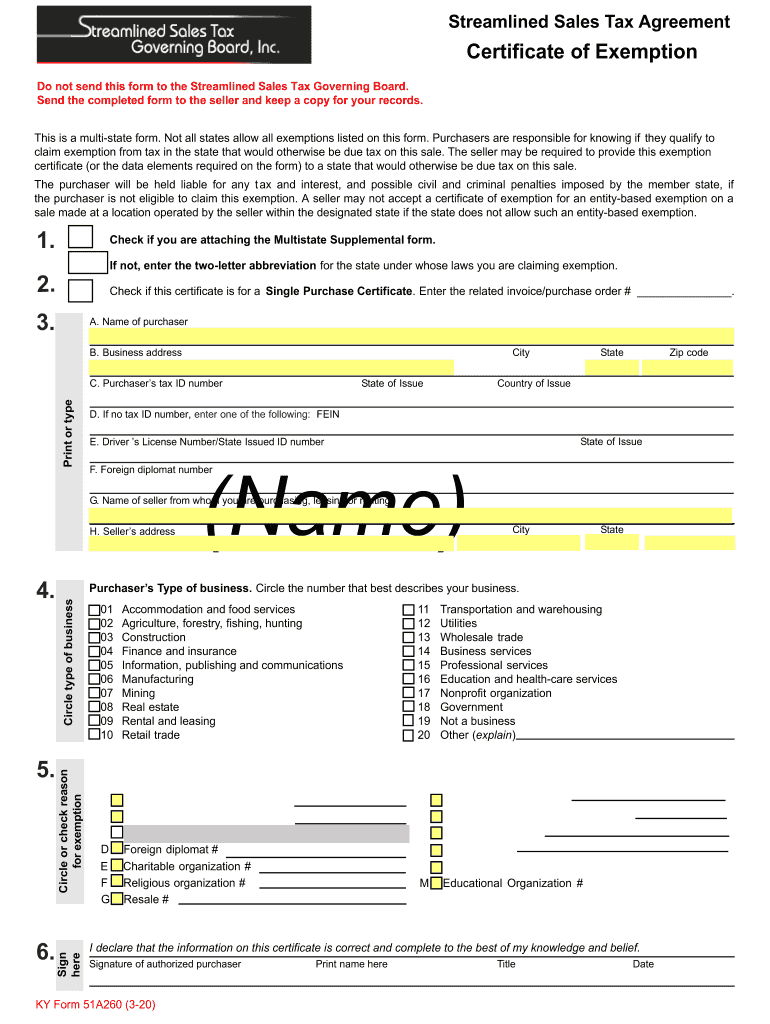

Revenue form 51a260 Fill out & sign online DocHub

Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Tobacco and vapor products taxes; It was only available for tax years 2019 and 2020. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Please click here to see if you are required to report kentucky.

Printable Kentucky State Tax Forms Printable World Holiday

The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Web use tax on individual income tax return. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web all kentucky wage earners are taxed at a flat 5% rate.

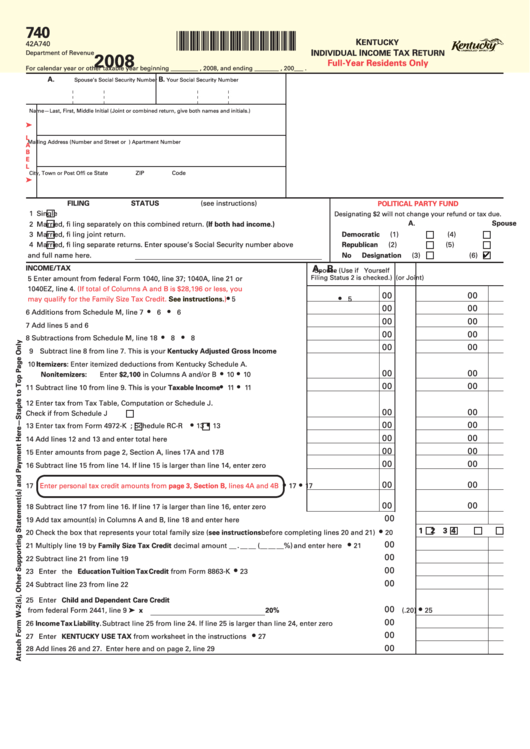

Fillable Form 740 Kentucky Individual Tax Return FullYear

Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Web printable income tax forms. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Please click here to see if you are required to report kentucky use tax on your individual income tax return. Web all.

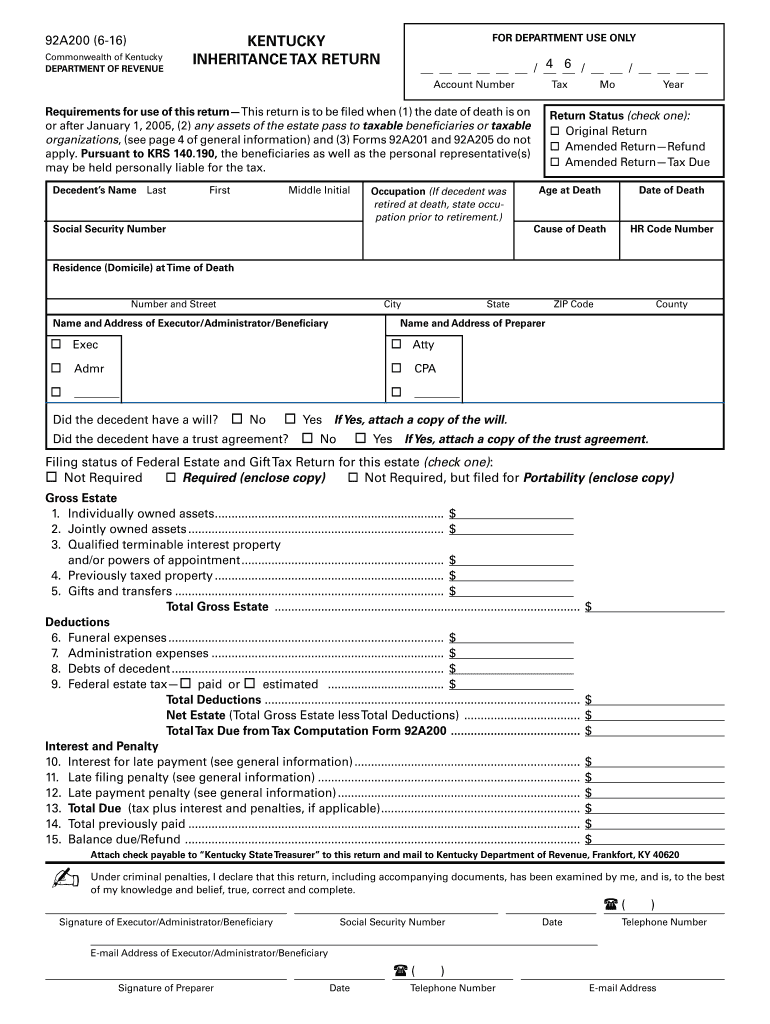

KY DoR 92A200 2016 Fill out Tax Template Online US Legal Forms

Web printable income tax forms. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Utility gross receipts license tax; It was only available for tax years 2019 and 2020. Income gap tax credit—this credit has expired.

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Please click here to see if you are required to report kentucky use tax on your individual income tax return. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). It was only available for tax years 2019 and 2020. Web kentucky has a flat state income tax of 5% , which is administered by the.

Fillable Form 740Ez Kentucky Individual Tax Return 2013

Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. Motor vehicle rental/ride share excise tax; • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual,.

Fillable Form 740Es Kentucky Estimated Tax Voucher 1999 printable

It was only available for tax years 2019 and 2020. The current tax year is 2022, with tax returns due in april 2023. Web use tax on individual income tax return. Motor vehicle rental/ride share excise tax; Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690.

Form PteWh (State Form 40a200) Kentucky Nonresident Tax

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Income gap tax credit—this credit has expired. Motor vehicle rental/ride share excise tax; Web printable income tax forms.

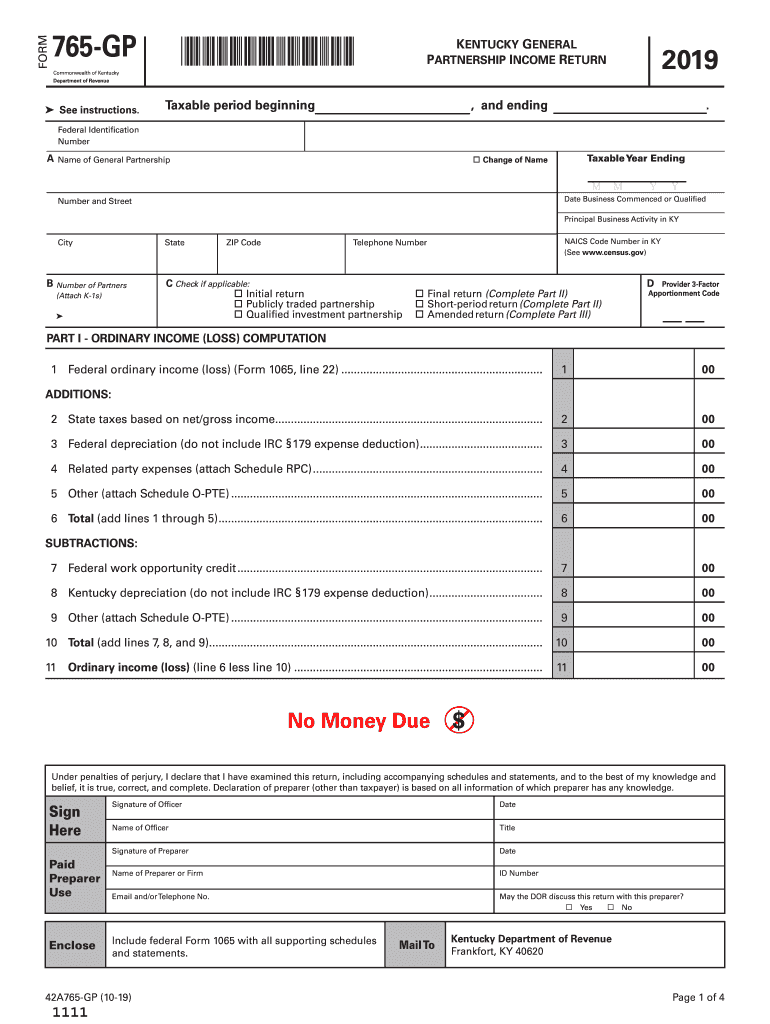

Ky Form 765 Gp Fill Out and Sign Printable PDF Template signNow

Tobacco and vapor products taxes; Kentucky income tax liability is not expected this year (see instructions) ̈ 2. The current tax year is 2022, with tax returns due in april 2023. It was only available for tax years 2019 and 2020. Income gap tax credit—this credit has expired.

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Kentucky has a state income tax of 5%. Tobacco and vapor products taxes; It was only available for tax years 2019 and 2020. Web printable income tax forms. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more. Web all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Web use tax on individual income tax return. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Motor vehicle rental/ride share excise tax; • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, Income gap tax credit—this credit has expired. The current tax year is 2022, with tax returns due in april 2023. Utility gross receipts license tax; Please click here to see if you are required to report kentucky use tax on your individual income tax return.

Tobacco And Vapor Products Taxes;

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Utility gross receipts license tax; Please click here to see if you are required to report kentucky use tax on your individual income tax return. Motor vehicle rental/ride share excise tax;

Web All Kentucky Wage Earners Are Taxed At A Flat 5% Rate With A Standard Deduction Allowance Of $2,690.

The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). • kentucky income tax payments currently due on april 15, 2020, may 15, 2020, and june 15, 2020 for individual, The current tax year is 2022, with tax returns due in april 2023. Web kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue.

The Current Tax Year Is 2022, And Most States Will Release Updated Tax Forms Between January And April Of 2023.

Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Kentucky has a state income tax of 5%. Income gap tax credit—this credit has expired. It was only available for tax years 2019 and 2020.

Web Use Tax On Individual Income Tax Return.

Web printable income tax forms. Web the 2021 threshold amount is $12,880 for a family size of one, $17,420 for a family of two, $21,960 for a family of three, and $26,500 for a family of four or more.