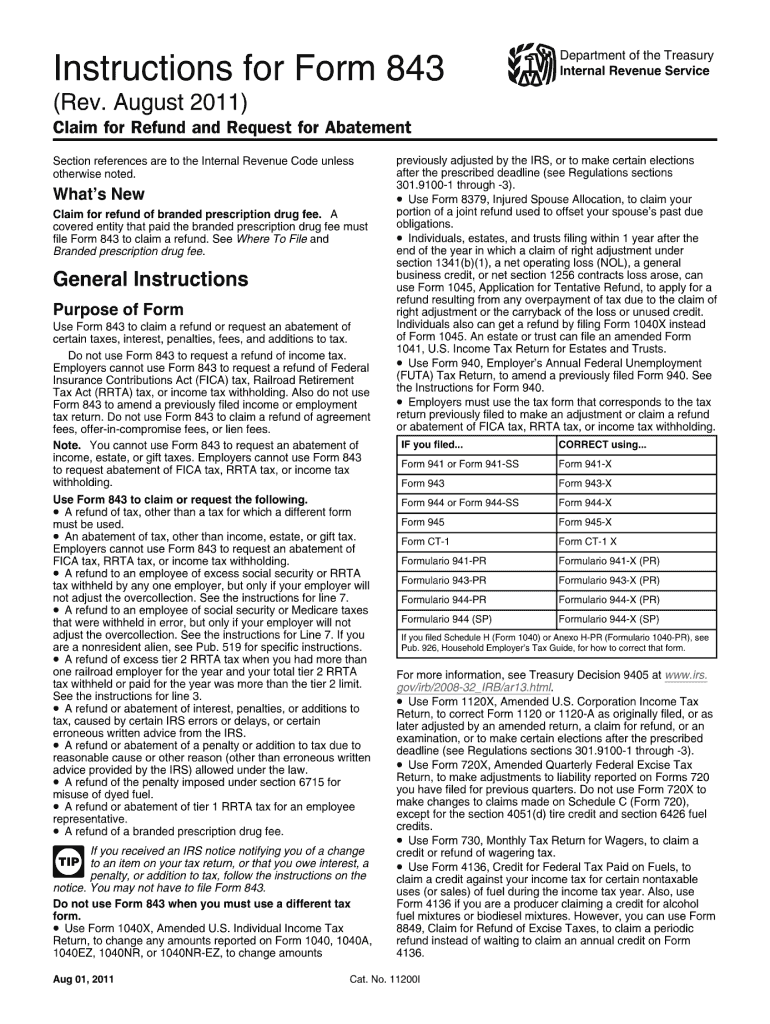

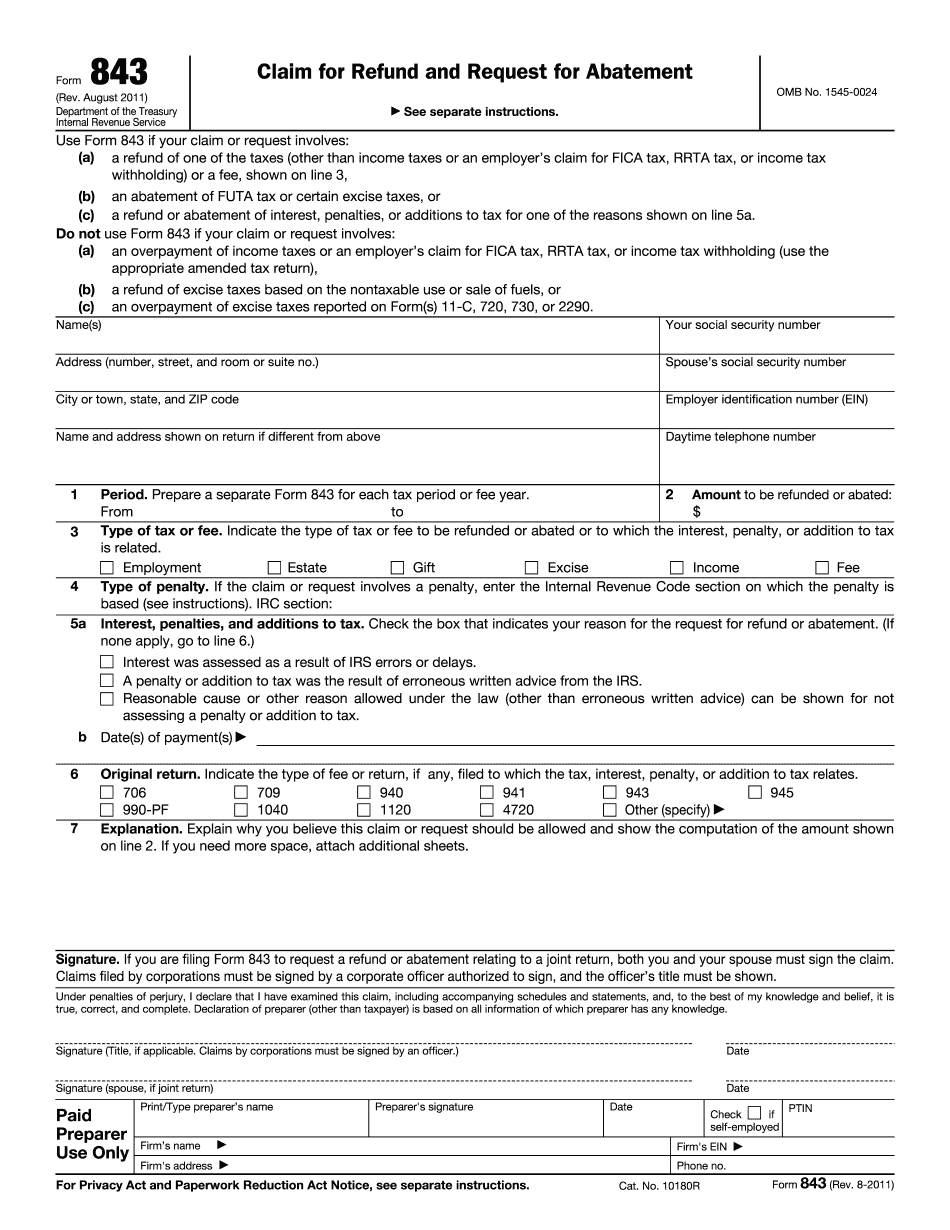

Irs Form 843 Printable - Web internal revenue service use form 843 if your claim or request involves: However, you cannot use form 843 to request a refund or an abatement of income tax. In response to an irs notice regarding a tax or fee related to certain taxes such as income, employment, gift, estate, excise, etc. Purposes of irs form 843. You can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web definition irs form 843 is a written request asking the government to waive certain penalties charged to taxpayers. Check the box print form 843 with complete return. Click on claim for refund (843). Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return.

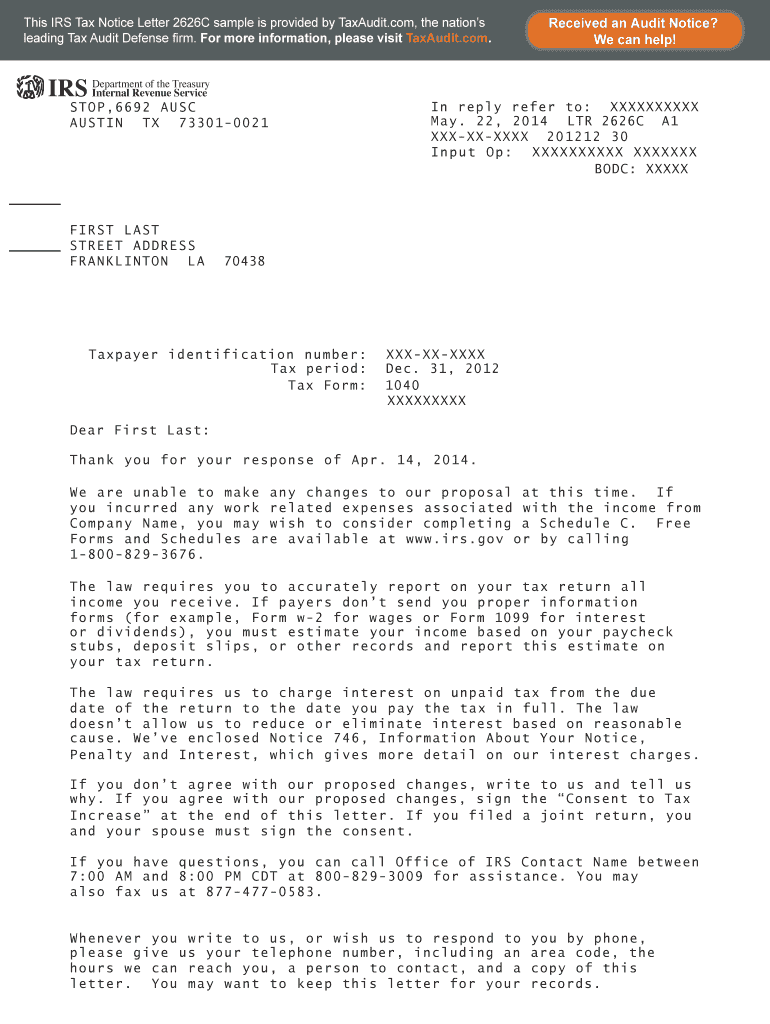

Irs Letter 2626c Fill Online, Printable, Fillable, Blank pdfFiller

A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an abatement of futa tax or certain excise taxes, or You can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest..

Irs form 843 2011 Fill out & sign online DocHub

Web definition irs form 843 is a written request asking the government to waive certain penalties charged to taxpayers. Web go to the input return tab. However, you cannot use form 843 to request a refund or an abatement of income tax. The address shown in the notice. Then mail the form to….

Irs Form 843 Printable Printable World Holiday

This provision for forgiveness has been in place since 2001. To request a claim for refund in a form 706/709 only tax matter. Enter the amount to be refunded or abated. Ad fill, sign, email irs 843 & more fillable forms, register and subscribe now! In response to an irs notice regarding a tax or fee related to certain taxes.

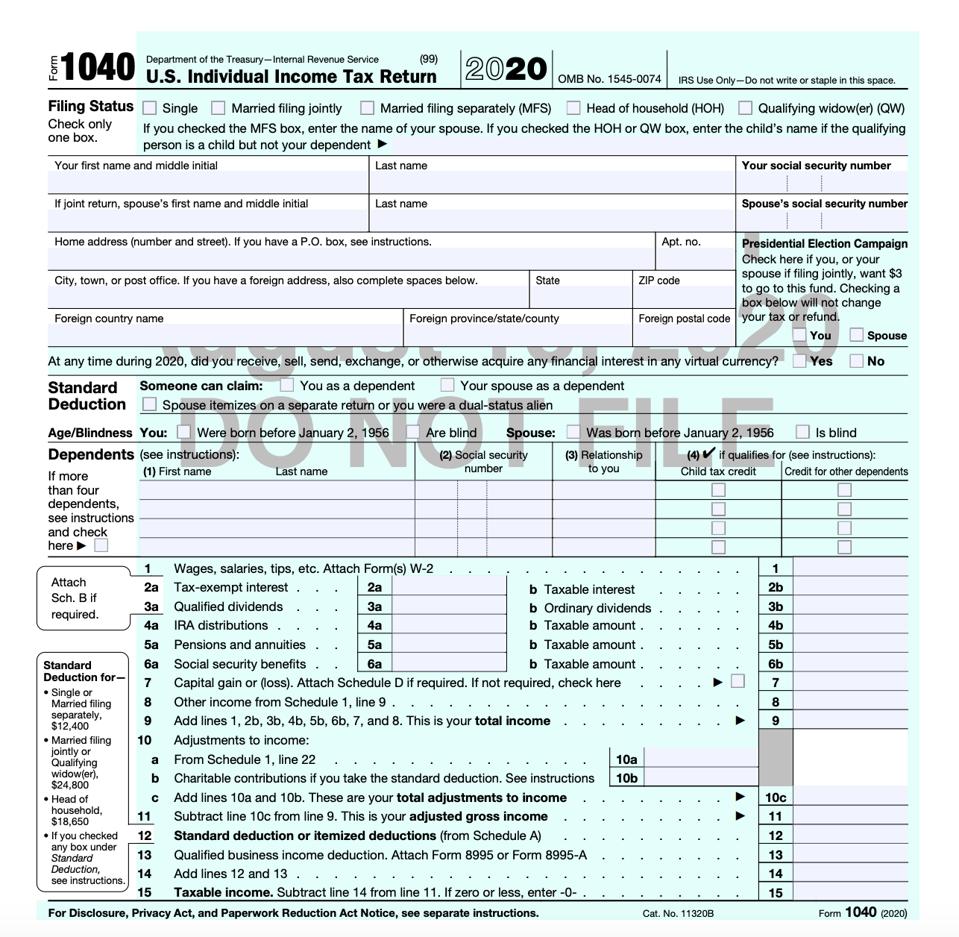

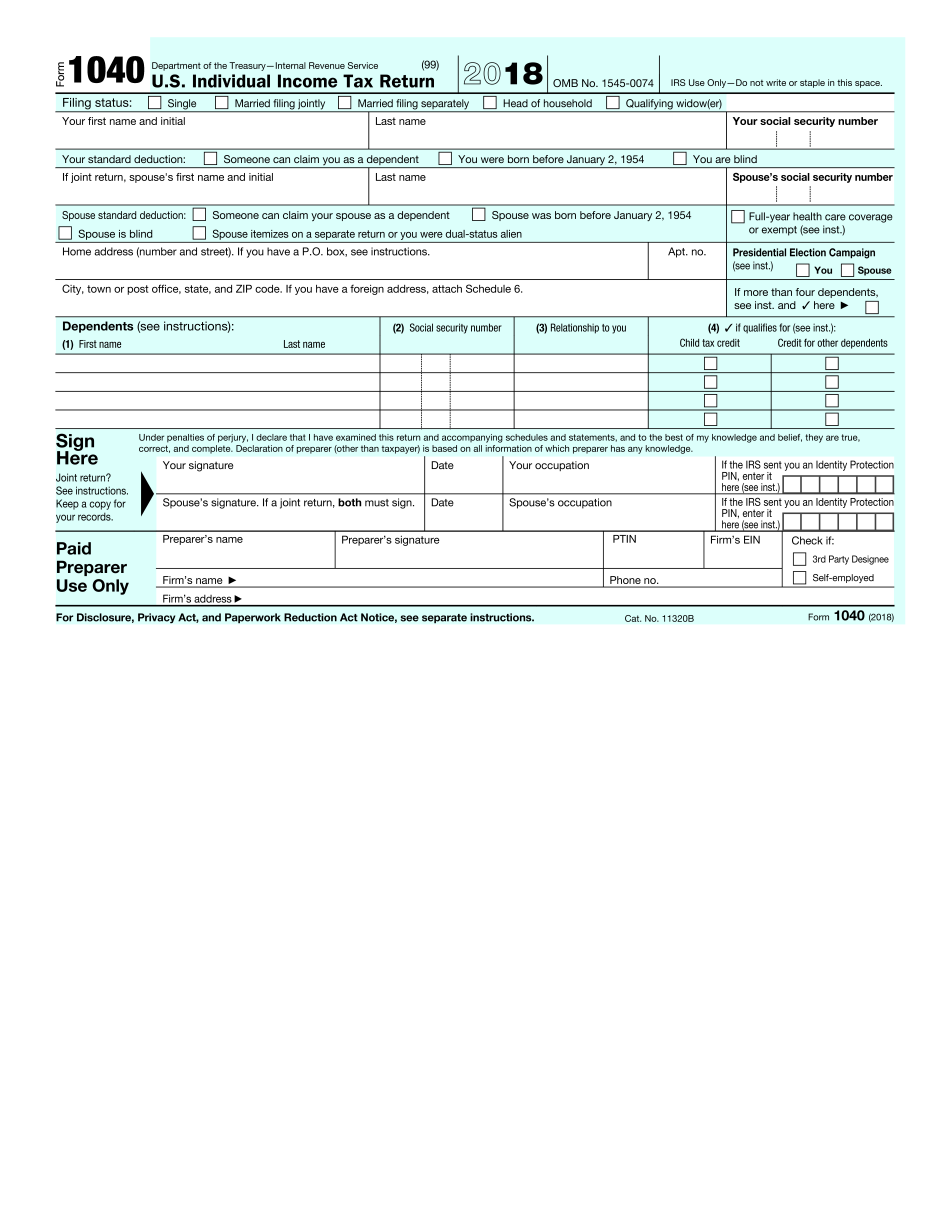

IRS Releases Draft Form 1040 Here’s What’s New For 2020

In response to an irs notice regarding a tax or fee related to certain taxes such as income, employment, gift, estate, excise, etc. In most cases, you can only get the interest erased if it’s related to an irs error or delay. Then mail the form to…. Web internal revenue service use form 843 if your claim or request involves:.

Form 843, Claim for Refund and Request for Abatement IRS Fill

Click on claim for refund (843). Web internal revenue service use form 843 if your claim or request involves: A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an abatement of futa tax or certain excise taxes, or.

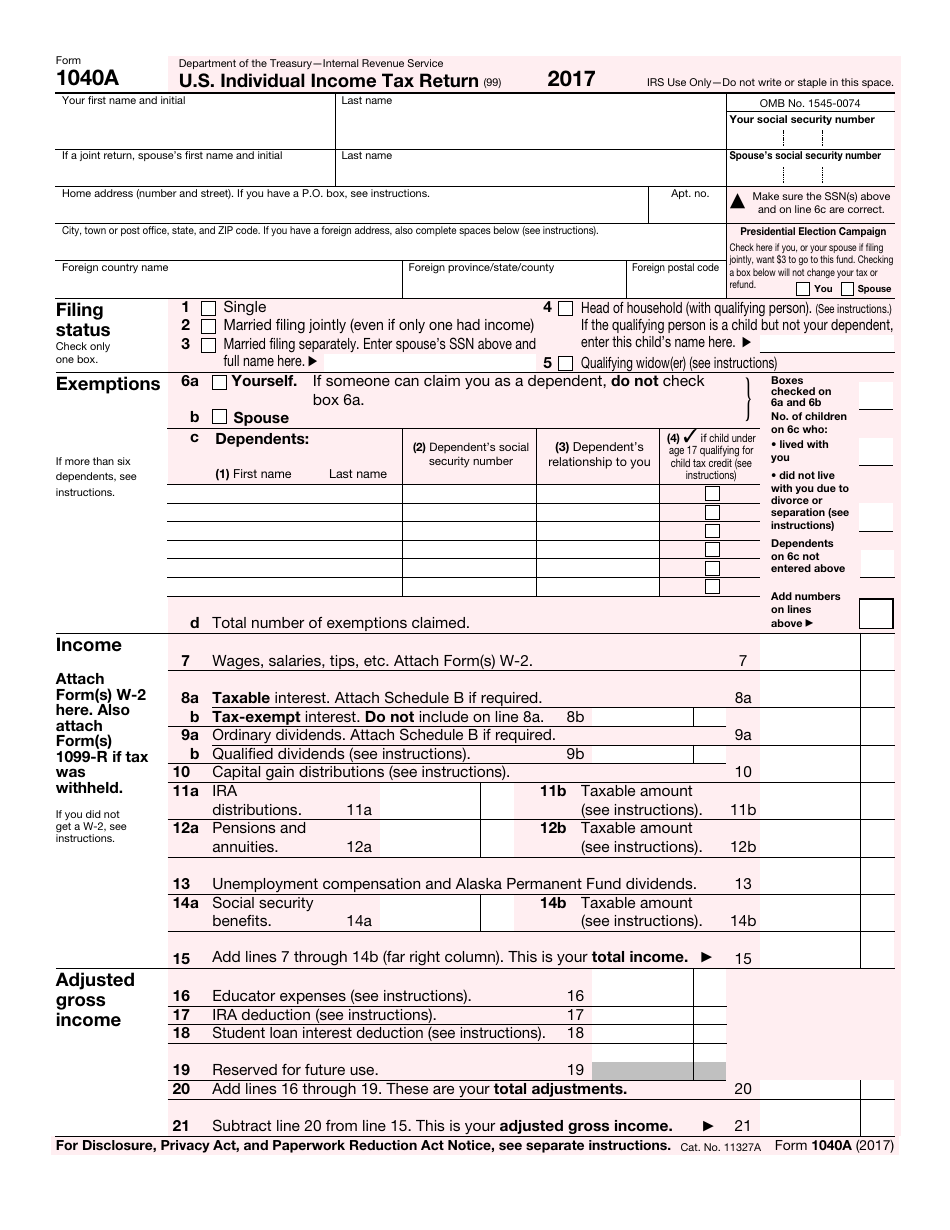

IRS Form 1040A Download Fillable PDF or Fill Online U.S. Individual

Try it for free now! Scroll down to the claim/request information section. However, you cannot use form 843 to request a refund or an abatement of income tax. In response to an irs notice regarding a tax or fee related to certain taxes such as income, employment, gift, estate, excise, etc. If you are an employer, you cannot use it.

20142019 Form IRS 1310 Fill Online, Printable, Fillable, Blank PDFfiller

Web internal revenue service use form 843 if your claim or request involves: The address shown in the notice. Scroll down to the claim/request information section. Try it for free now! You can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest.

Irs Fill and Sign Printable Template Online US Legal Forms

Web mailing addresses for form 843. Upload, modify or create forms. You can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. Web definition irs form 843 is a written request asking the government to waive certain penalties charged to taxpayers. More about the federal form 843 we last updated federal form.

1040 Form Pdf Fillable Printable Forms Free Online

If you are an employer, you cannot use it to request abatement of fica tax, rrta tax, or income tax withholding. This form is for income earned in tax year 2022, with tax returns due in april 2023. These include penalties for failure to pay, failure to file, and the failure of employers to make tax deposits as required by.

Irs Form 843 Fillable and Editable PDF Template

Purposes of irs form 843. Ad irs form 843 & more, subscribe now. Instructions for form 941 pdf If you are an employer, you cannot use it to request abatement of fica tax, rrta tax, or income tax withholding. Upload, modify or create forms.

Instructions for form 941 pdf Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Web internal revenue service use form 843 if your claim or request involves: Click on claim for refund (843). In response to an irs notice regarding a tax or fee related to certain taxes such as income, employment, gift, estate, excise, etc. Web mailing addresses for form 843. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. However, you cannot use form 843 to request a refund or an abatement of income tax. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Upload, modify or create forms. A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an abatement of futa tax or certain excise taxes, or Check the box print form 843 with complete return. More about the federal form 843 we last updated federal form 843 in february 2023 from the federal internal revenue service. To request a claim for refund in a form 706/709 only tax matter. Web irs form 843 (request for abatement & refund): Web employer's quarterly federal tax return. Web definition irs form 843 is a written request asking the government to waive certain penalties charged to taxpayers. Enter the amount to be refunded or abated. In most cases, you can only get the interest erased if it’s related to an irs error or delay. The address shown in the notice.

More About The Federal Form 843 We Last Updated Federal Form 843 In February 2023 From The Federal Internal Revenue Service.

The address shown in the notice. Check the box print form 843 with complete return. However, you cannot use form 843 to request a refund or an abatement of income tax. If you are filing form 843.

Employers Who Withhold Income Taxes, Social Security Tax, Or Medicare Tax From Employee's Paychecks Or Who Must Pay The Employer's Portion Of Social Security Or Medicare Tax.

This provision for forgiveness has been in place since 2001. Web go to the input return tab. Web employer's quarterly federal tax return. Then mail the form to….

Web Mailing Addresses For Form 843.

Ad fill, sign, email irs 843 & more fillable forms, register and subscribe now! Instructions for form 941 pdf Web definition irs form 843 is a written request asking the government to waive certain penalties charged to taxpayers. Web internal revenue service use form 843 if your claim or request involves:

In Response To An Irs Notice Regarding A Tax Or Fee Related To Certain Taxes Such As Income, Employment, Gift, Estate, Excise, Etc.

Click on claim for refund (843). A refund of one of the taxes (other than income taxes or an employer’s claim for fica tax, rrta tax, or income tax withholding) or a fee, shown on line 3, an abatement of futa tax or certain excise taxes, or These include penalties for failure to pay, failure to file, and the failure of employers to make tax deposits as required by law. This form is for income earned in tax year 2022, with tax returns due in april 2023.