Illinois State Tax Forms Printable - Details on how to only prepare and print an. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Complete, edit or print tax forms instantly. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Related illinois individual income tax forms: Illinois state representative jackie hass job fair. For more information about the illinois. Web you can print other illinois tax forms here. Taxformfinder has an additional 75 illinois income tax forms that you may need, plus.

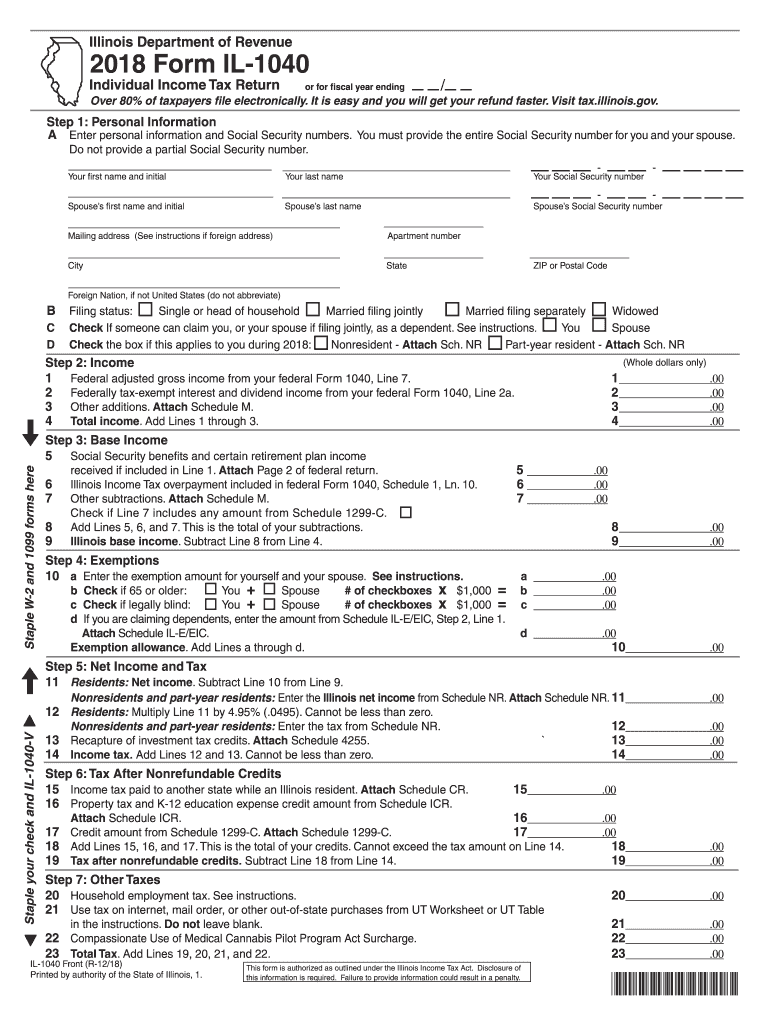

Illinois 1040 schedule form Fill out & sign online DocHub

We last updated the individual income tax return in january 2023, so this is. Illinois state representative jackie hass job fair. This form is used by illinois residents who file an individual income tax return. Web you can print other illinois tax forms here. 2023 estimated income tax payments for individuals.

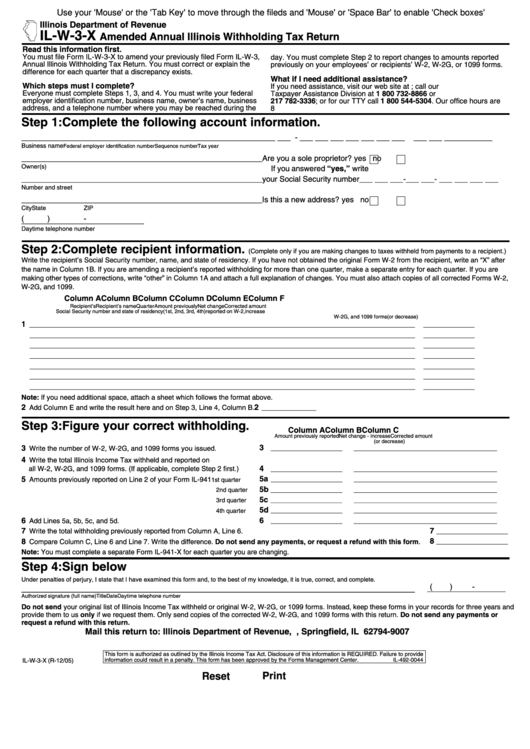

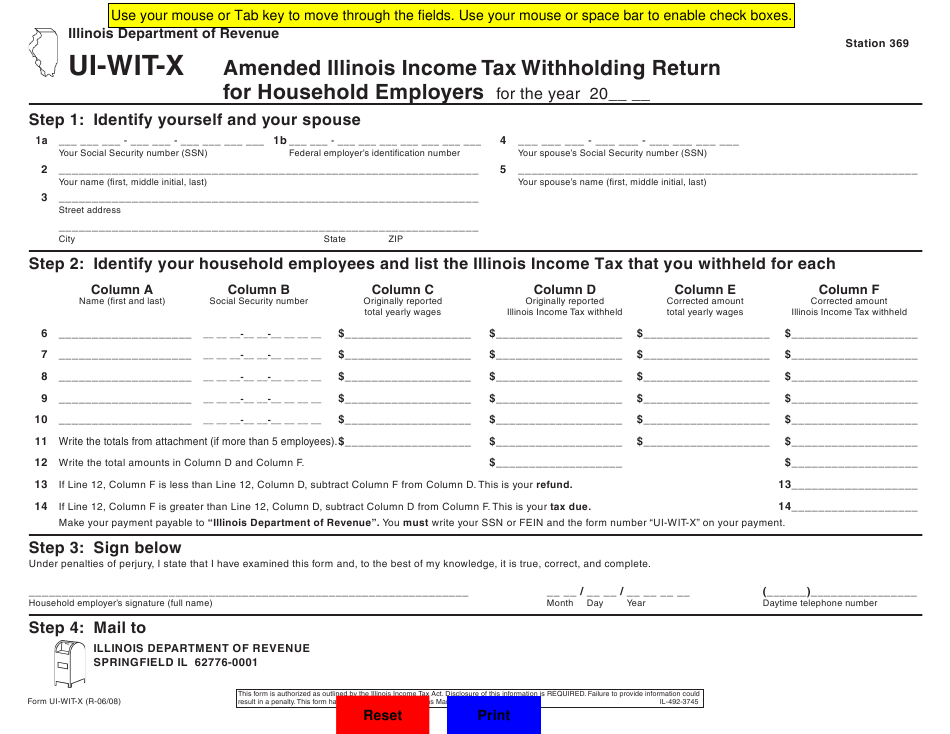

Fillable Form IlW3X Amended Annual Illinois Withholding Tax Return

Taxformfinder has an additional 75 illinois income tax forms that you may need, plus. Illinois state representative jackie hass job fair. Here is a comprehensive list of illinois. For more information about the illinois. Web 63 rows illinois has a flat state income tax of 4.95%, which is administered by the illinois.

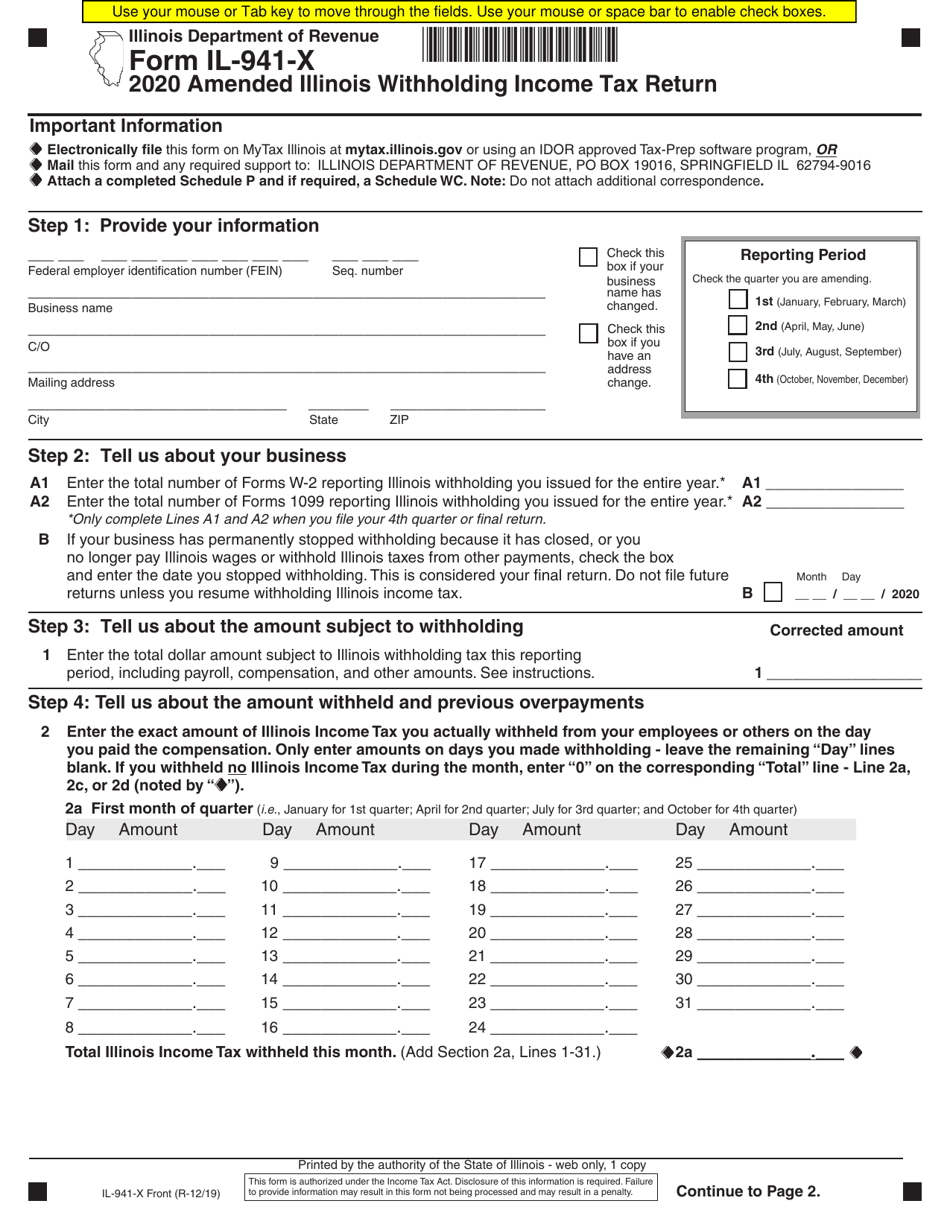

Form IL941X Download Fillable PDF or Fill Online Amended Illinois

2022 estimated income tax payments for individuals. Complete, edit or print tax forms instantly. Where do i get help? Web tax.illinois.gov to obtain a copy. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and.

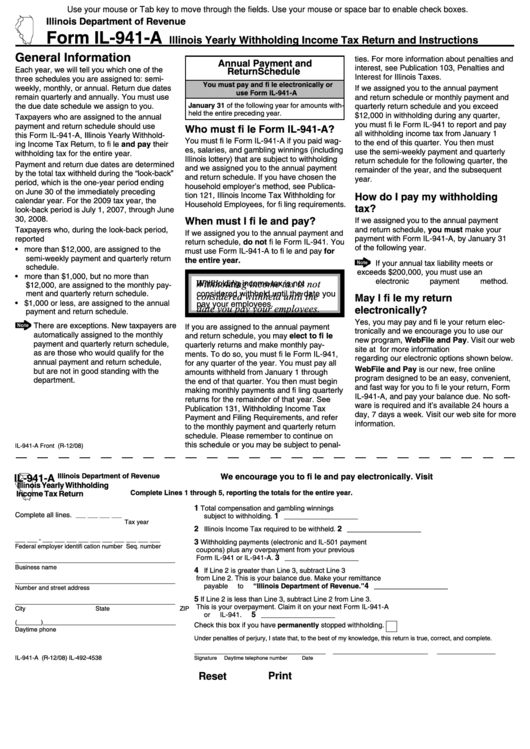

Fillable Form Il941A Illinois Yearly Withholding Tax Return

This form is used by illinois residents who file an individual income tax return. Taxformfinder has an additional 75 illinois income tax forms that you may need, plus. Here is a comprehensive list of illinois. Employee’s illinois withholding allowance certificate and instructions. Illinois state representative jackie hass job fair.

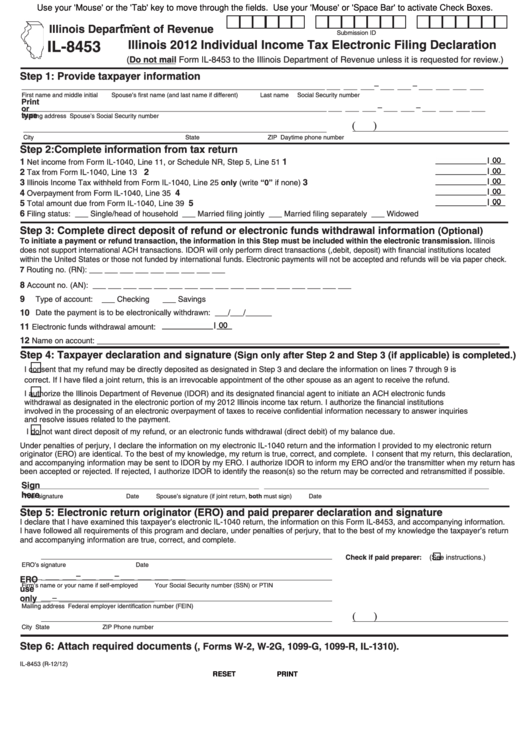

Fillable Form Il8453 Illinois Individual Tax Electronic

2022 estimated income tax payments for individuals. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. We last updated the individual income tax return in january 2023, so this is. Complete, edit or print tax forms instantly. Web you can.

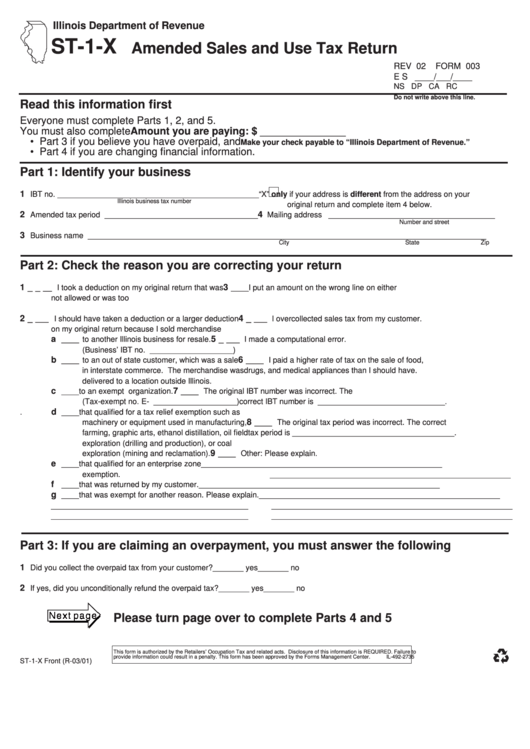

Form St1X Amended Sales And Use Tax Return Form State Of Illinois

Employee’s illinois withholding allowance certificate and instructions. We last updated the individual income tax return in january 2023, so this is. 2022 estimated income tax payments for individuals. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Use this form.

New Employee Paperwork Tax Forms In Illinois 2023

Be sure to verify that the form you are downloading is for the correct year. Complete, edit or print tax forms instantly. Related illinois individual income tax forms: We last updated the individual income tax return in january 2023, so this is. 2023 estimated income tax payments for individuals.

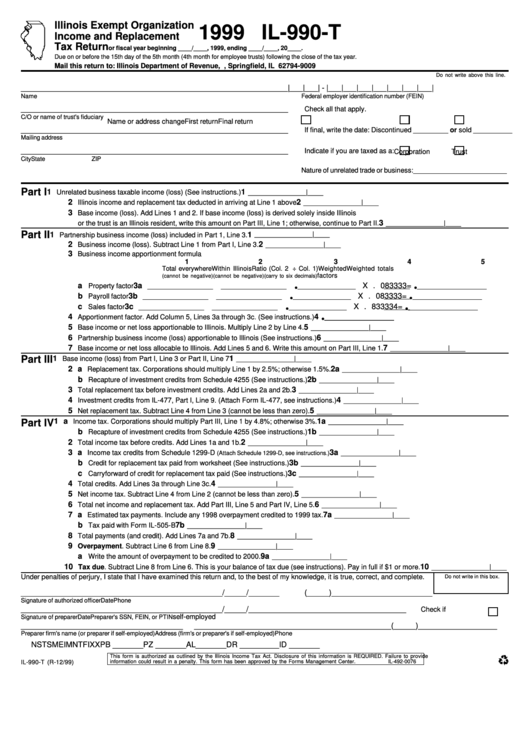

Form Il990T Illinois Exempt Organization And Replacement Tax

Be sure to verify that the form you are downloading is for the correct year. For more information about the illinois. We last updated the individual income tax return in january 2023, so this is. 2022 estimated income tax payments for individuals. This form is used by illinois residents who file an individual income tax return.

Il State Tax Form Fill Out and Sign Printable PDF Template signNow

This form is used by illinois residents who file an individual income tax return. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. 2022 estimated income tax payments for individuals. Web illinois department of revenue. Web you can print other.

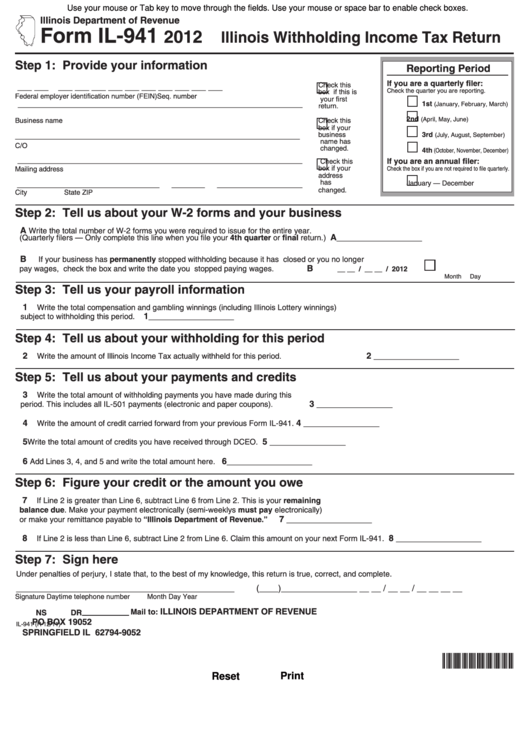

Fillable Form Il941 Illinois Withholding Tax Return 2012

Illinois state representative jackie hass job fair. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Employee’s illinois withholding allowance certificate and instructions. Taxformfinder has an additional 75 illinois income tax forms that you may need, plus. Web you can print other illinois tax forms here.

Here is a comprehensive list of illinois. 2023 estimated income tax payments for individuals. Illinois state representative jackie hass job fair. Web we last updated the illinois income tax instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. 2022 estimated income tax payments for individuals. Related illinois individual income tax forms: This form is used by illinois residents who file an individual income tax return. Web you can print other illinois tax forms here. For more information about the illinois. Be sure to verify that the form you are downloading is for the correct year. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. Taxformfinder has an additional 75 illinois income tax forms that you may need, plus. We last updated the individual income tax return in january 2023, so this is. Details on how to only prepare and print an. Where do i get help? Employee’s illinois withholding allowance certificate and instructions. Complete, edit or print tax forms instantly. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Illinois comptroller susana mendoza joined wxan to talk about the rainy day fund. Web tax.illinois.gov to obtain a copy.

Web We Last Updated The Illinois Income Tax Instructional Booklet In February 2023, So This Is The Latest Version Of Income Tax Instructions, Fully Updated For Tax Year 2022.

Illinois comptroller susana mendoza joined wxan to talk about the rainy day fund. Taxformfinder has an additional 75 illinois income tax forms that you may need, plus. Web you can print other illinois tax forms here. For more information about the illinois.

Employee’s Illinois Withholding Allowance Certificate And Instructions.

Be sure to verify that the form you are downloading is for the correct year. 2022 estimated income tax payments for individuals. Web tax.illinois.gov to obtain a copy. Where do i get help?

Illinois State Representative Jackie Hass Job Fair.

Related illinois individual income tax forms: Web 63 rows illinois has a flat state income tax of 4.95%, which is administered by the illinois. Web illinois department of revenue. Complete, edit or print tax forms instantly.

2023 Estimated Income Tax Payments For Individuals.

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Here is a comprehensive list of illinois. Use this form for payments that are due on april 18, 2022, june 15, 2022, september 15, 2022, and. We last updated the individual income tax return in january 2023, so this is.