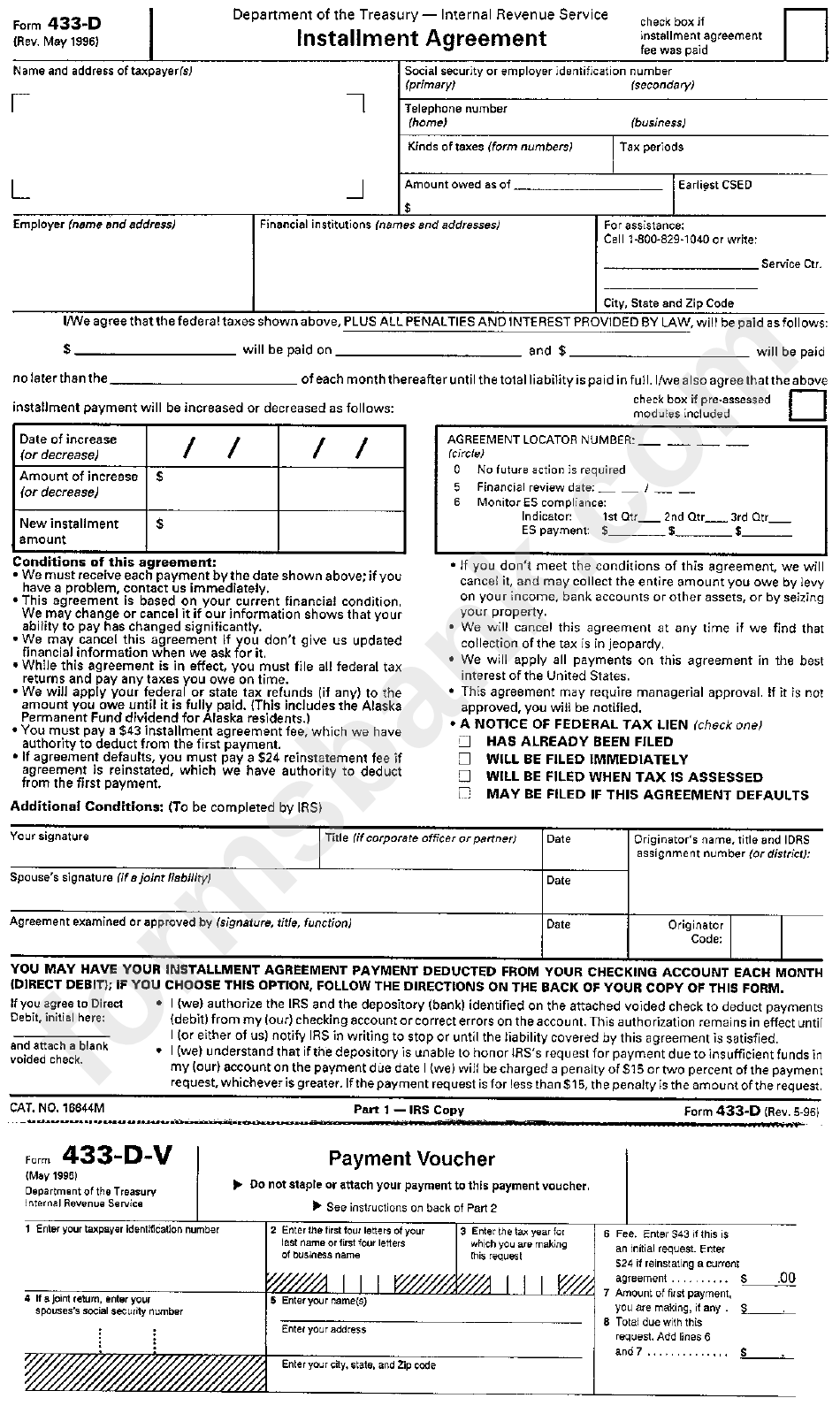

Irs Form 433 D Printable - Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. Use this form if you are an individual who owes income tax on a form 1040, u.s. Web the document you are trying to load requires adobe reader 8 or higher. Get ready for this year's tax season quickly and safely with pdffiller! Printing and scanning is no longer the best way to manage documents. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people using a shareable link or. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Easily fill out pdf blank, edit, and sign them. Web edit irs form 433 d.

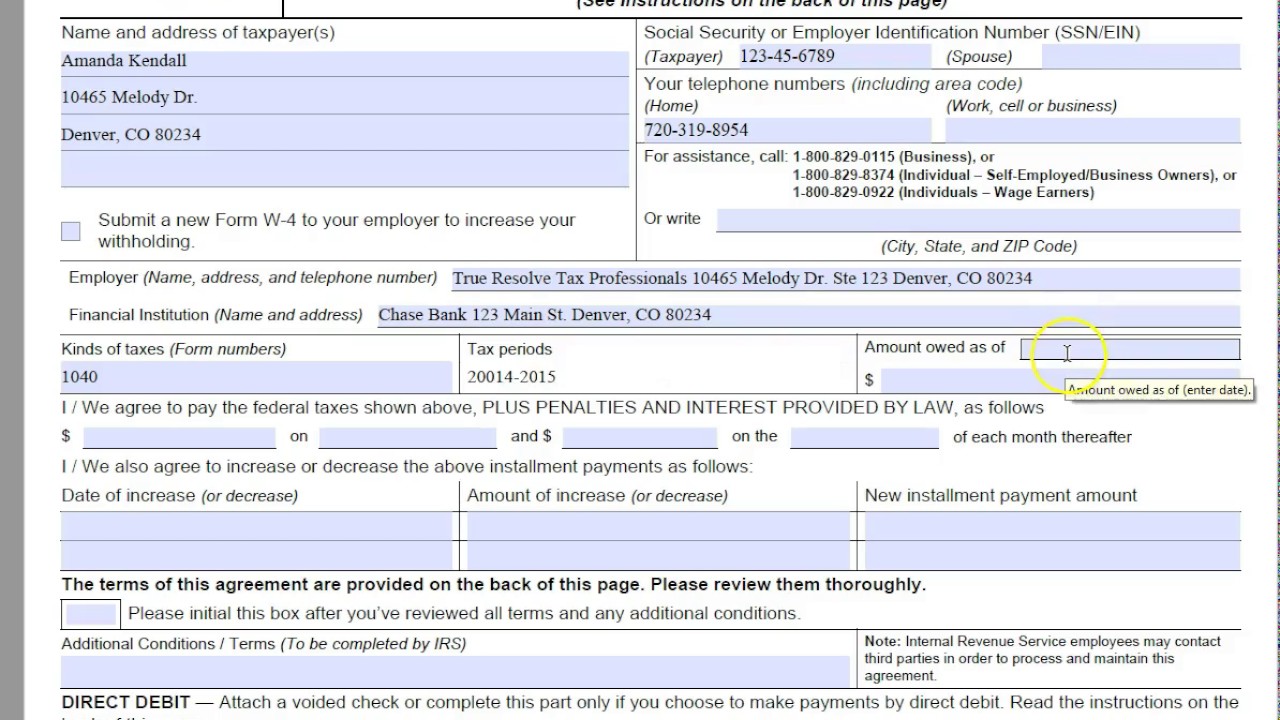

How To Fill Out Form 433 D Paul Johnson's Templates

Web edit irs form 433 d. Get ready for this year's tax season quickly and safely with pdffiller! Web handy tips for filling out irs form 433 d online. Use this form if you are an individual who owes income tax on a form 1040, u.s. Sign it in a few clicks draw your signature, type it, upload its image,.

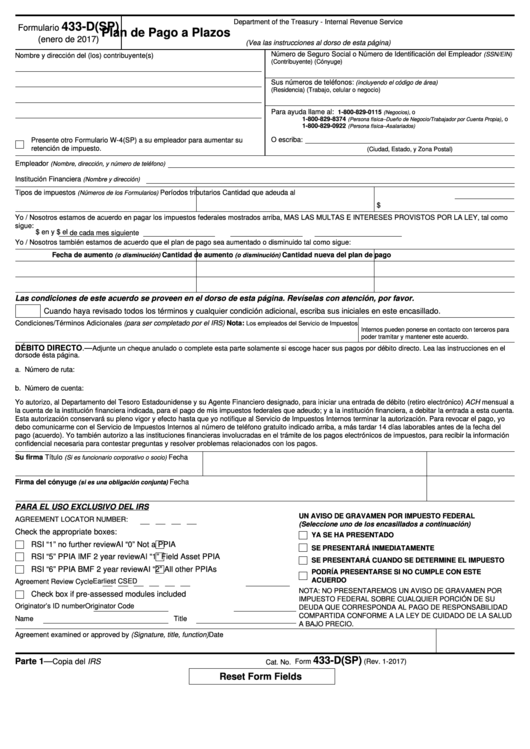

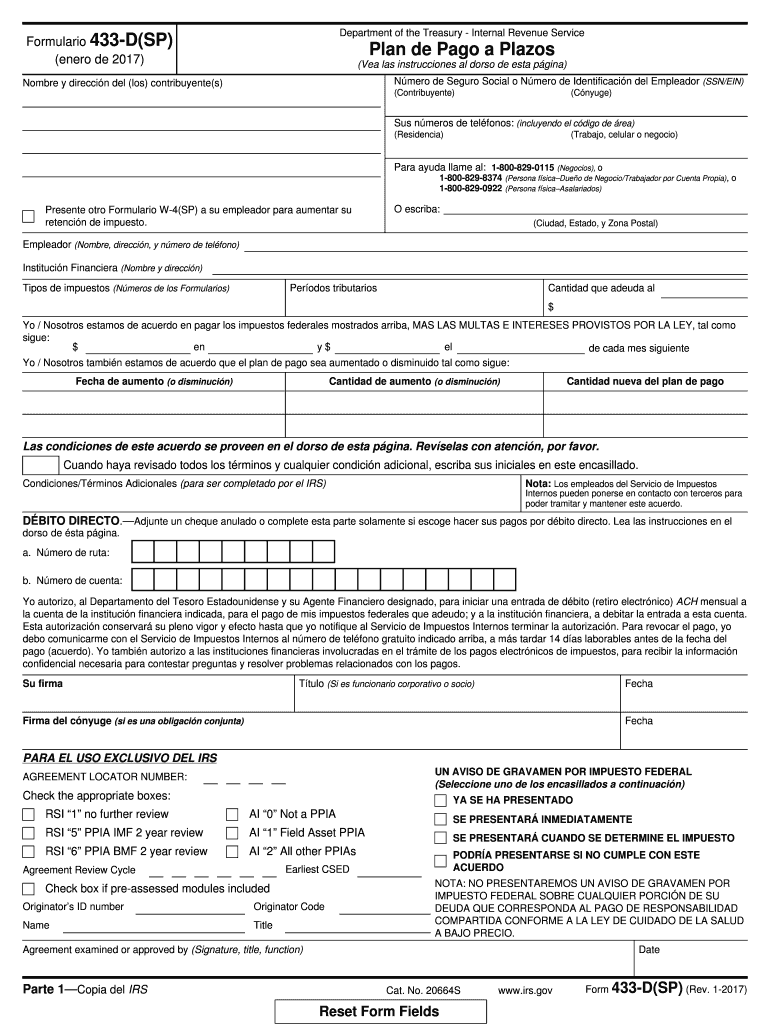

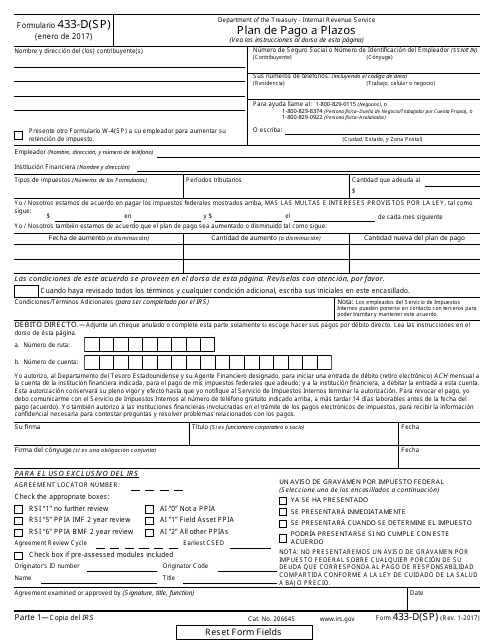

Fillable Formulario 433D(Sp) Plan De Pago A Plazos (Spanish Version

Web open the form 433d and follow the instructions easily sign the 433d with your finger send filled & signed 433d irs form or save rate the irs 433d 4.7 satisfied 255 votes quick guide on how to complete where to mail form 433 d 2021. For example, we may ask Get ready for this year's tax season quickly and.

2017 Form IRS 433D (SP) Fill Online, Printable, Fillable, Blank

You may not have the adobe reader installed or your viewing environment may not be properly. (a large down payment may streamline the installment agreement process, pay your balance faster and reduce the amount of penalties and interest. Please retain a copy of your completed form and supporting documentation. Printing and scanning is no longer the best way to manage.

IRS Formulario 433D(SP) Download Fillable PDF or Fill Online Plan De

Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people using a shareable link or. Web edit irs form 433 d. As with all irs red tape, there are a few forms to file before you are approved for installment payments. Edit your form 433d online type text, add images,.

F Financial Necessary Latest Fill Out and Sign Printable PDF Template

Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people using a shareable link or. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. Get the irs form 433 d accomplished. Printing and scanning is no longer.

Irs Form 433 D Printable Master of Documents

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. The document finalizes the agreement between an individual or a business and the irs. Use this form if you are an individual who owes income tax on a form 1040, u.s. (a large down payment may streamline.

Completing Form 433D Installment Agreement After IRS Audit Tax Law

When applying this irs form, the taxpayer will receive permission from the internal revenue service to pay another amount of taxes. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. For example, we may ask Web edit irs form 433 d. Easily fill out.

IRS Form 433D Fill out, Edit & Print Instantly

Web handy tips for filling out irs form 433 d online. Easily fill out pdf blank, edit, and sign them. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Answer all questions or write n/a if the question is not. Please retain a copy.

Form 433D Installment Agreement printable pdf download

This form is for income earned in tax year 2022, with tax returns due in april 2023. Easily fill out pdf blank, edit, and sign them. (a large down payment may streamline the installment agreement process, pay your balance faster and reduce the amount of penalties and interest. Save or instantly send your ready documents. Answer all questions or write.

8. Form 433D if you can't pay your tax bill mediafeed

(a large down payment may streamline the installment agreement process, pay your balance faster and reduce the amount of penalties and interest. Get the irs form 433 d accomplished. The document finalizes the agreement between an individual or a business and the irs. Use this form if you are an individual who owes income tax on a form 1040, u.s..

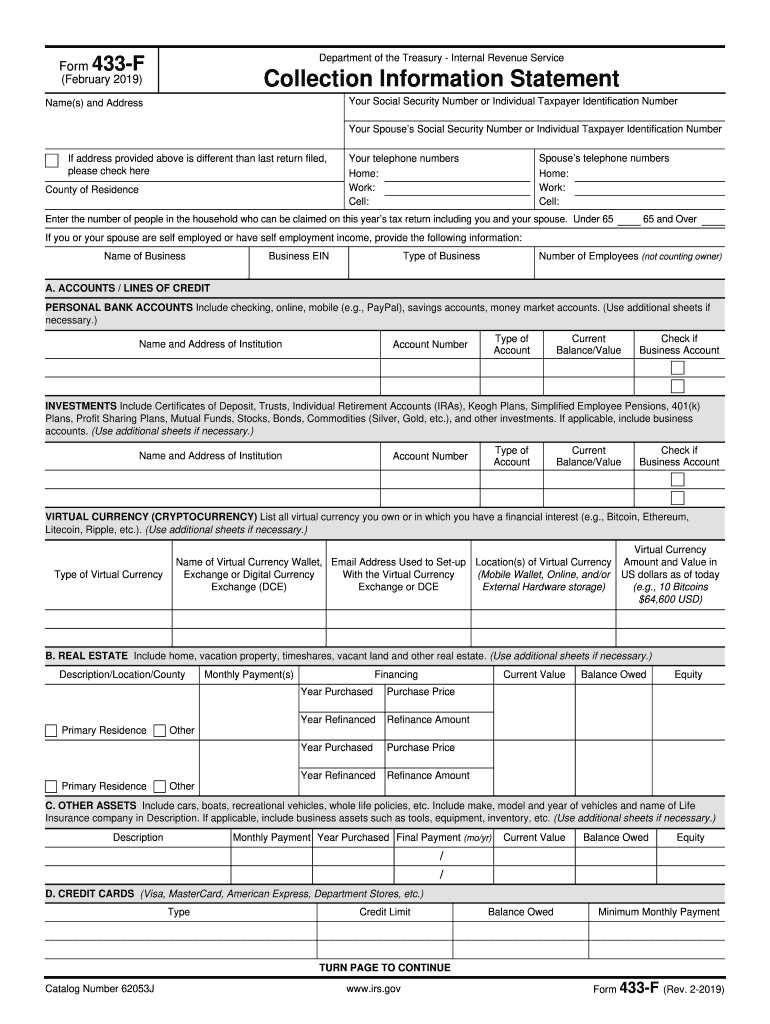

Save or instantly send your ready documents. The document finalizes the agreement between an individual or a business and the irs. County of residence your social security number or individual taxpayer identification number Web the document you are trying to load requires adobe reader 8 or higher. When applying this irs form, the taxpayer will receive permission from the internal revenue service to pay another amount of taxes. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our. Easily add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your paperwork. For example, we may ask Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. After we review your completed form, we may contact you for additional information. Web edit irs form 433 d. Get ready for this year's tax season quickly and safely with pdffiller! This form is for income earned in tax year 2022, with tax returns due in april 2023. Answer all questions or write n/a if the question is not. Web originator code title agreement examined or approved by (signature, title, function) notice of federal tax lien (check one box below) has already been filed will be filed immediately will be filed when tax is assessed may be filed if this agreement defaults Printing and scanning is no longer the best way to manage documents. Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. As with all irs red tape, there are a few forms to file before you are approved for installment payments. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people using a shareable link or. Get the irs form 433 d accomplished.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Web the document you are trying to load requires adobe reader 8 or higher. For example, we may ask Web open the form 433d and follow the instructions easily sign the 433d with your finger send filled & signed 433d irs form or save rate the irs 433d 4.7 satisfied 255 votes quick guide on how to complete where to mail form 433 d 2021. Web edit irs form 433 d.

After We Review Your Completed Form, We May Contact You For Additional Information.

Benefits of an irs installment agreement (a large down payment may streamline the installment agreement process, pay your balance faster and reduce the amount of penalties and interest. You may not have the adobe reader installed or your viewing environment may not be properly. Save or instantly send your ready documents.

Easily Add And Highlight Text, Insert Pictures, Checkmarks, And Symbols, Drop New Fillable Areas, And Rearrange Or Remove Pages From Your Paperwork.

When applying this irs form, the taxpayer will receive permission from the internal revenue service to pay another amount of taxes. County of residence your social security number or individual taxpayer identification number Difference between tax forms basic conditions instructions for compiling the. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

Get the irs form 433 d accomplished. Share your form with others send irs form 433 d via email, link, or fax. Easily fill out pdf blank, edit, and sign them. As with all irs red tape, there are a few forms to file before you are approved for installment payments.